René Lomelí Ojeda - Partner, 500 Global

Podcast Notes, Episode 3 - LatAm’s Startup Boom: 500 Global, Angel Investing, and the Next Decade

La Frontera Podcast, Episode 3 - LatAm’s Startup Boom: 500 Global, Angel Investing, and the Next Decade

René Lomelí Ojeda

René has been there since day one — building communities, working with founders, and funding great startups in Mexico and throughout Latin America. His passion for building the ecosystem is unmatched, and his insights into everything from angel investors to what it takes to create value in LatAm are invaluable. Let’s dive in!

Episode 3 Summary

In this episode, we sit down with René Lomelí Ojeda, a Partner at 500 Global, who has been instrumental in building the LatAm startup ecosystem since its early days. We discuss the evolution of 500 Global (previously 500 LatAm), the changing landscape for startups and VCs, and the essential traits of successful angel investors. René́́́ also shares insights into 500 Global’s investment process, their value-add beyond capital, and the biggest risks international VCs see in LatAm. But it’s not all about caution — René explains why he remains bullish on LatAm for the next decade and why investors should be paying close attention. 🌎📈

In Today's Newsletter

500 Global: Backing the Future of LatAm Startups

💰 Assets Under Management: $2.7B

📈 Number of Funds: 19+ globally, with multiple regional funds

🌎 Portfolio Companies: 2,600+ worldwide, 200+ in LatAm

🦄 Unicorns: 51 across regions

🏆 Exits: Multiple successful IPOs and acquisitions across regions (such as VivaReal and Ayenda in LatAm)

🚀 Notable Investments in LatAm:

99 Minutos – Last-mile logistics and delivery solutions.

Avify – E-commerce sales channel and inventory management platform.

Cicada – Alternative Trading System (ATS) for bond trading in Mexico.

Clip🦄 – Leading digital payments company in Mexico.

Conekta – Digital payments and financial infrastructure.

Justo – Online grocery platform.

Konfío🦄 – SME lending and financial services.

Palenca – Payroll API to validate income and employment information.

500 Global invests primarily in Pre-Seed, Seed, and Series A rounds, pairing capital with hands-on support to founders. The firm differentiates itself through a strong presence in the startup communities in LatAm, its accelerator-style program, and a global network of investors and mentors to help startups scale. 🌟

The Origins of 500 Global in LatAm

René started his career as a community builder, working with early entrepreneurs who would gather on weekends to develop projects. Many didn’t realize they could turn these projects into full-time businesses—what was missing was capital. 💡

Meanwhile, Santiago Zavala, co-founder of Mexican VC, was running hackathons in Mexico City. Mexican VC became one of the first early-stage funds in the region, investing in seven companies, including Conekta. Seeing the potential in the region, 500 Global partnered with Mexican VC, making its first international micro-fund investment. That was the beginning of 500 LatAm. 🚀

500 Global: Beyond Capital

While funding is essential, 500 Global’s success in LatAm is built on four pillars:

1️⃣ Capital – The core of any VC. 500 Global invests $300k in LatAm startups — giving them 12-18 months of runway, enough time to show traction ahead of their next raise.💰

2️⃣ Community – Bringing together founders, investors, and mentors to build a robust network. We experienced the community first-hand when René invited us to attend a social event with portfolio founders in Mexico City. The community extends even further with 500’s accelerator-style program that’s designed to help founders build a strong foundation upon which to build their business.🤝

3️⃣ Code – Developing internal tools (like Descubre.vc) to improve deal flow and portfolio support. Not surprising given Santiago’s and René́’s backgrounds. 💻

4️⃣ Content – Educational initiatives such as podcasts and publications to engage the ecosystem. 📚🎙️

📈 Follow-On Investment Strategy

500 Global has evolved its follow-on strategy significantly:

Initial investments have grown from $80K to $300K, offering startups 12-18 months of runway. ⏳

The 500 team will monitor each startup over the next year, creating a short-list of promising companies.

Follow-on investments range between $200K-$500K, allowing for better long-term support. 📈

The focus is on making better follow-on investments through an extended observation period and maintaining ownership levels to ensure fund-level returns despite dilution. 🔄

Angel Investing in LatAm: The Landscape & Evolution

René launched the Ángeles de LatAm podcast to answer two important questions:

What makes for a successful angel investor in LatAm?

How do we share their knowledge and best practices with others?

His goal was to inspire more folks to write their first check. ✍️

🔑 Key Insights on Angel Investors in LatAm:

Every angel investor defines success differently and it’s typically based on their goals, relationship with the entrepreneurs, and investment history. Returns are important but are typically not the number one priority for angels. 🎯

René believes angel check sizes should be a meaningful amount that helps founders extend their runway. He mentions a range of $10,000 to $25,000. If an investor wants to place smaller bets, syndicates are the best route. 💰

Network effects matter: René believes every founder, no matter their socioeconomic background, is just three calls away from their first angel investor. Don’t limit yourself to family and friends, reach out to your former professors and bosses.📞📞📞

A growing community: 11 years ago, LatAm had almost no angel investors. Today, searching “Angel Investor” on LinkedIn and filtering for cities like Mexico City shows pages of results. 📊

Most angel investors in LatAm have full-time jobs. Those who build portfolios often transition into full-time VC roles or become LPs in funds. 🎓

International Investors & LatAm: Opportunities & Risks

🤝 Why International VCs Should Look at LatAm:

Local-International VC partnerships are powerful: Local investors provide crucial market insights, while international funds bring larger capital reserves for later rounds. 🔄💼

Stronger startup pipeline: Compared to a decade ago, raising a Series A or B round is now much more common. 📊

Regional growth cycles: Many international investors left LatAm post-2021, but 500 Global sees this as an opportunity to double down. 💪

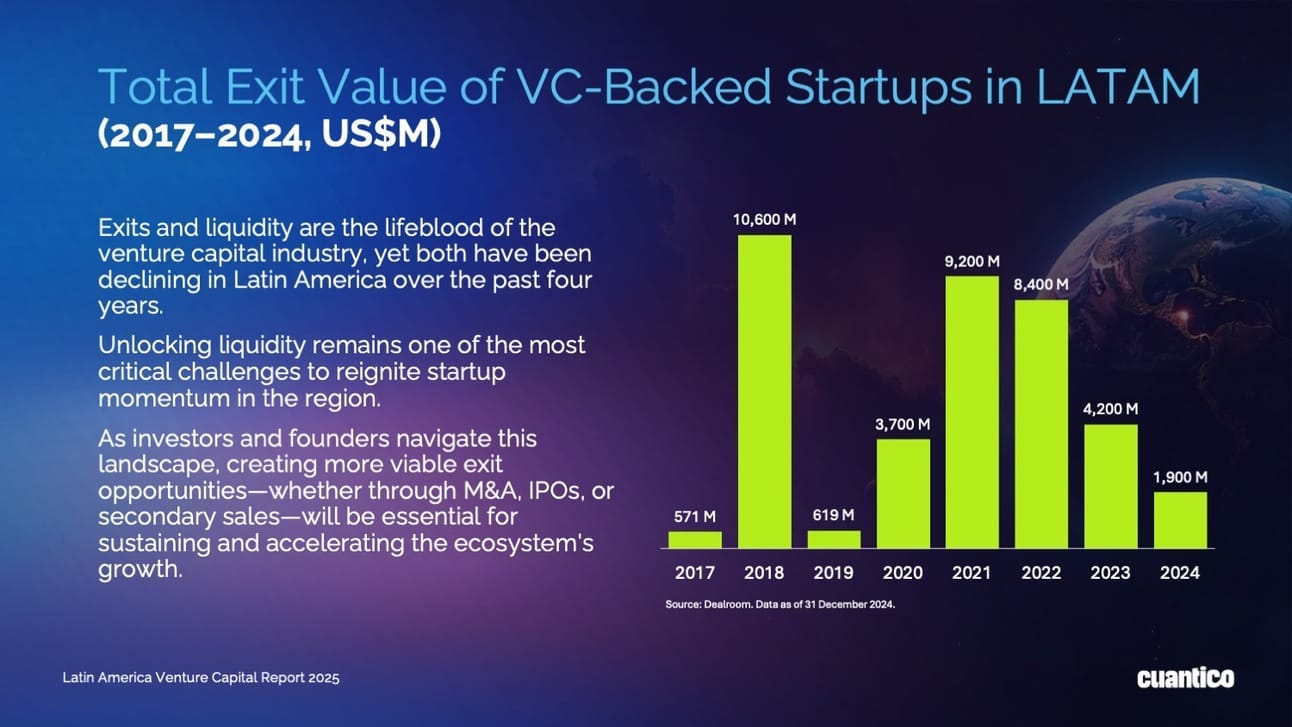

⚠️ Biggest Risk: Liquidity

The primary concern for international investors remains liquidity. 💵

Early investors (2010-2015) are still waiting for significant exits. ⏳

Compared to Silicon Valley, LatAm’s timeline for liquidity is longer due to ecosystem maturity. 🔄

However, value is clearly being created: Companies like Clip, Konfío, and Conekta are now widely used. For example, walking into any shop in Mexico City or even with a street vendor you will see a Clip POS system. Successful exits are just a matter of time. 🚀

Final Thoughts: Why Now is the Best Time to Invest in LatAm

Despite global pullbacks in venture funding, René is more optimistic than ever about the next 5-10 years in LatAm. 🌟 The ecosystem has matured, founders are more sophisticated, and funding pathways are clearer. With valuations corrected after the 2021 bubble, the opportunities are ripe. 🏆

Investors who enter the market now will benefit from the groundwork laid over the last decade. And as liquidity concerns resolve, LatAm could become one of the most attractive emerging markets globally for venture capital. 💰📈

For anyone looking to understand and invest in LatAm’s startup boom, there has never been a better time to get involved. 🚀🔥

Follow René for more insights

Check out René’s podcast, Ángeles de LatAm, here:

Angeles de LatAm - Listen on Spotify

Thanks for reading!

Be sure to share La Frontera with your network if you enjoyed this episode!