Maria Gutierrez Peñaloza – Co-founding Partner, Nido Ventures

Podcast Notes, Episode 12 – Investing Across Borders: Nido’s B2B Thesis for Mexico’s Golden Age

La Frontera 🌵 Podcast, Episode 12 - Investing Across Borders: Nido’s B2B Thesis for Mexico’s Golden Age

Maria Gutierrez Peñaloza

In this episode, we sit down with Maria Gutierrez Peñaloza, co-founding partner of Nido Ventures, to explore why Mexico may be entering its “golden decade” for tech and cross-border innovation. Maria shares how her background working in supply chain in Silicon Valley shaped Nido’s investment thesis, and why they’re backing B2B startups transforming legacy industries. We dive into nearshoring trends turbocharging Mexico’s economy, the specific industries ripe for disruption, and how Nido bridges two worlds – mobilizing U.S. capital to seize opportunities south of the border.

From her days managing Apple’s supply chain to launching a VC fund with a fellow engineer, Maria’s journey offers a masterclass in leveraging operational expertise in venture capital. She breaks down the “arbitrage opportunity” she sees in Mexican tech, how Nido navigates tariff turbulence and geopolitical shifts with a long-term lens, and why engineers-turned-investors can spot and scale the next wave of industrial innovation in Latin America.

We were introduced to Maria by our friend Renata (Nido’s boots-on-the-ground in CDMX – gracias, Renata!). We knew we had to talk to Maria after hearing about Nido’s product-driven approach and bold cross-border thesis. This conversation didn’t disappoint – it’s packed with candid insights and actionable takeaways for investors and founders alike, from scaling B2B startups to building community around venture.

Episode 12 Summary

Engineers to Investors: How Maria and her co-founder Ana Carolina leveraged their technical backgrounds at Apple and LinkedIn to carve out a unique edge in Mexico’s VC ecosystem (dominated by finance folks).

Mexico’s “Golden Decade”: Why Nido believes the next 5–10 years will be Mexico’s financial golden age for tech, as nearshoring and economic shifts unlock a $800B+ opportunity.

Long-Term > Short Shocks: How Mexico’s new leadership (shout-out to a PhD president) is calmly navigating tariff wars – and why Nido plays the long game, focusing on fundamental trends over transient headlines.

Industries Ripe for Reinvention: From supply chain and fintech infrastructure to mining, energy, and even insurance – the massive legacy sectors where tech innovation can create outsized impact (and returns).

Bridging Two Worlds: Nido’s cross-border strategy to mobilize US capital into LatAm startups – being based in California and Mexico City means access to Silicon Valley networks while staying deeply plugged into the local scene.

Multiple Exit Routes: The evolving landscape of exits in LatAm – with more secondaries and M&A opportunities emerging well before IPO, early-stage investors can win without waiting a decade.

Building Community: How Nido’s content platform “ConteNIDO” educates 13,000+ readers about Mexico’s tech ecosystem, bridging a knowledge gap and inspiring the next generation of founders.

In Today's Newsletter

🪺Nido Ventures: Transforming Foundational Industries Through B2B Innovation

💰 Assets Under Management: $7M (Fund I)

📍 HQ: Los Angeles & San Francisco, with team in Mexico City

🎯 Stage Focus: Pre-Seed and Seed

🌎 Geographic Focus: U.S./Mexico corridor (selectively broader LatAm adjacency)

💵 Check Size: $100K–$200K initial; selective follow-ons via SPVs

🏆 Portfolio: 23 B2B startups in fintech, compliance, industrial tech, logistics, healthcare, and AI

🚀 Notable Investments:

EFEX – B2B banking infrastructure for fintechs & marketplaces in international trade

Arkham – Enterprise data & AI platform connecting fragmented operations

Desteia – Real-time trade tech with AI-driven freight visibility and customs automation

Telepatía – AI co-pilot improving healthcare efficiency and reducing physician burnout

Buo – Predictive people analytics platform for workforce-driven profitability

Mekan – Sales acceleration platform for auto parts dealers in Latin America

🔧 Unique Model: Founded by engineers with deep operator experience, Nido takes a product-driven lens to investing. The team specifically backs founders modernizing “boring” legacy industries with high-friction workflows, where technical edge and early commercial traction matter most.

📈 Exit Strategy: Structured for long-term ownership, but opportunistic about liquidity via M&A or secondaries by Series B/C (no waiting 10+ years for an IPO to cash out).

(Learn more at nido.ventures)

🧠 From Stanford to Startup Thesis – The Origin of Nido

Maria and her co-founder Ana Carolina first met as engineering students at Stanford, never imagining they’d one day run a VC fund together. Post-college, Maria managed supply chain operations for Apple (yes, the iPhone supply chain!), while Caro was writing code at LinkedIn and leading engineering at a Mexican startup. They both dreamed of launching a startup, but while brainstorming ideas they stumbled on a different opportunity: investing in the kinds of companies they wished they could build.

In 2020, the duo started angel investing and quickly found their niche. With backgrounds in hardware and software, they could spot technically solid founders and assess products in industries they knew inside-out. This gave them an edge to get into high-quality cap tables early. By 2022, they launched Nido Ventures around a clear thesis: back B2B tech startups transforming traditional sectors in Mexico and the U.S. cross-border space – areas they not only understand, but where their experience can meaningfully help founders go from 0 to 1.

“We brought the technical and tangible expertise as operators… The rest of the ecosystem was mostly coming from financial backgrounds. We were the perfect complement. I think even today we’re pretty much the only GPs with these backgrounds in Mexico.”

Maria Gutierrez Peñaloza

Armed with engineering know-how and on-the-ground experience, Maria and Caro set out to be the kind of investors they wished they’d had as founders – rolling up their sleeves, debugging problems alongside startups, and focusing on solving real industrial pain points. That tech-operator DNA remains Nido’s secret sauce in sourcing deals and helping portfolio companies scale.

💰 Mexico’s Golden Decade: The $800B Opportunity

If you ask Maria “Why Mexico, why now?”, be prepared for some eye-opening numbers and historical context. Latin America’s second-largest economy is on the cusp of a major tech-driven boom – and Nido doesn’t want to miss it.

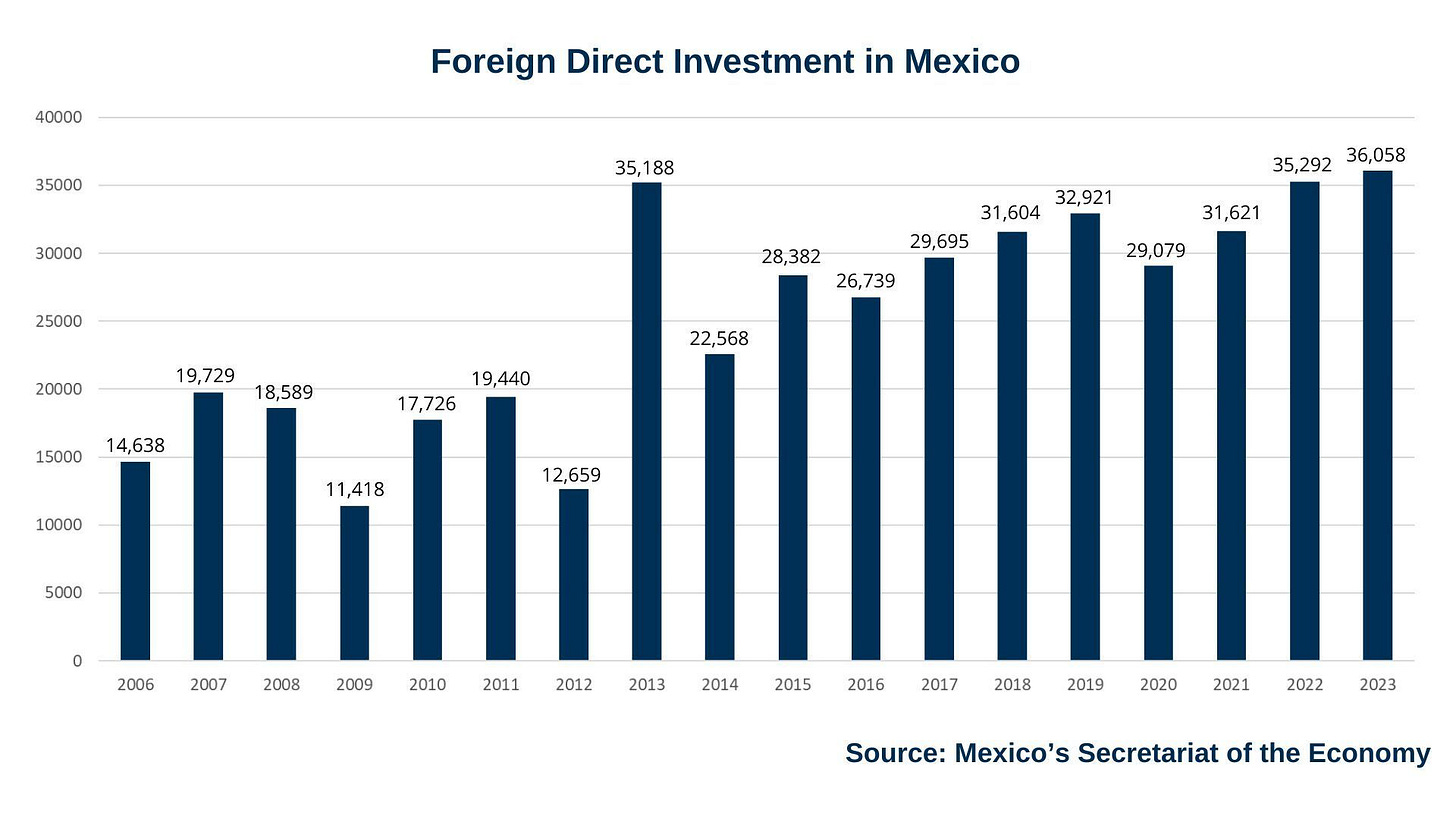

Mexico today enjoys unprecedented tailwinds: global manufacturers are “nearshoring” operations to Mexico at record rates (thank you, strained U.S.–China relations), and the U.S.–Mexico trade corridor is a whopping $800 billion market that’s not slowing down. Yet tech investment is still relatively tiny compared to the opportunity, which spells upside. Maria argues that over the next decade, Mexico’s tech ecosystem could mature rapidly, delivering outsized returns to those who get in early.

“I think the next five to 10 years are gonna be our financial golden age. Capital markets will come back and give rise to amazing companies – and also give returns to investors so they keep putting money into the ecosystem.”

M.G. Peñaloza

Crucially, Mexico’s macro stability and leadership are bolstering this optimism. While headlines often focus on political noise or U.S. tariff threats, the reality on the ground is confidence: Mexico’s likely next president (Claudia Sheinbaum, a PhD in energy) is signaling pragmatic, pro-growth policies. When a recent U.S. tariff tantrum hit, Sheinbaum responded with calm and contingency plans “A through F” rather than panic. Nido’s take? Don’t sweat short-term turbulence.

“I don’t think we’ll be in a tariff situation a year from now – it’s not a long-term problem. The time to invest is when others are retreating, because that’s when arbitrage opportunities come into play.”

M.G. Peñaloza

In other words, contrarian investing 101: when nervous money pulls back, smart money leans in. By focusing on Mexico’s strong fundamentals – a huge young population, rising internet adoption, industrial resurgence – Nido aims to capitalize on the gap between perception and reality. The bet is that global VC dollars will inevitably correct upward to reflect Mexico’s true potential. As Maria puts it, “If everyone else is fearful, we’re greedy.”

🏗️ Industries Ready for Disruption

Nido’s thesis isn’t just macro theory – it’s very specific about where innovation (and investment) can have the biggest impact. Maria lights up when talking about the unsexy, “old-school” industries that keep Mexico (and the world) running: manufacturing, logistics, construction, energy, agriculture, mining, you name it. These sectors share two things: they’re critically important and they’ve lagged in tech adoption. Perfect recipe for disruption.

Some areas Nido is particularly excited about in the next 5–10 years:

Horizontal Plays: Foundational tech that cuts across sectors. Think supply chain management, financial infrastructure, or B2B logistics platforms – tools that every industry can use to modernize (and that create network effects across the economy).

Deep Vertical Opportunities: Specific sectors that are enormous in Mexico. For example, mining (Mexico is a top global minerals exporter), energy (especially if the sector opens up to more private innovation), construction, auto manufacturing, and agriculture. Each of these has massive inefficiencies and “analog” processes ripe for a digital overhaul.

Under-the-Radar Gems: Maria even finds promise in areas others overlook. Case in point – insurance. Yes, insurance! It’s not flashy, but a startup bringing efficiency to the insurance market could unlock huge value in a region where risk is often mispriced or uninsured. “I never thought I’d say this out loud, but I’m excited about a company in the insurance space,” Maria admits. When even insurance gets an engineer excited, you know there’s upside!

Healthcare (with a local twist): The health tech boom in the U.S. doesn’t automatically translate to Latin America – different systems, regulations, and patient needs mean U.S. solutions don’t fit LatAm. Nido sees an opening for localized healthcare startups that build from the ground up for Mexicans. “The U.S. products don’t translate to Latin America at all… so healthcare is something we’re excited about,” says Maria. Imagine telemedicine, patient records, or medical devices reinvented for the realities of emerging markets.

What’s common across these opportunities is that they’re huge markets hiding in plain sight. Many Mexican industries are dominated by a few incumbents or still run on literal pen-and-paper. A nimble startup with the right tech could rapidly become the go-to solution and establish a lasting moat. Nido’s already backing startups in several of these spaces (see Notable Investments above), from AI-driven freight logistics to enterprise data platforms.

As Maria notes, the ecosystem itself is maturing to support this specialization. Until recently, most Mexican VC funds were generalists, doing a bit of everything. Now, with funds like Nido, founders in say, an industrial IoT startup, can pitch investors who actually get their domain. That’s a positive sign for better founder-investor fit and ultimately better outcomes across the board.

🌉 Engineers at the Helm: Nido’s Cross-Border Edge

One of Nido’s distinguishing traits is literally being in two places at once. Maria and Ana Caro are based in California, while Renata (and many portfolio companies) are in Mexico City. This cross-border presence is very intentional. It allows Nido to tap into the best of both worlds: the vast capital and network of U.S. tech investors, combined with deep local knowledge and on-site support in Mexico.

“What we want is to make sure we’re bringing more capital from the US into Mexico. Being here [in the US] helps us mobilize that capital because we’re considered a local partner. We understand Mexico very well… we have the dual-market advantage.”

M.G. Peñaloza

For U.S. investors (LPs) seeking LatAm exposure, Nido becomes a trusted bridge. Maria pitches Nido as the fund that knows how to pick winners in Mexico and navigate the nuances of doing business there – from cultural norms to regulatory hurdles – all while reporting and communicating in a Silicon Valley-savvy way. This pitch has resonated: many of Nido’s backers are U.S. venture funds or tech execs who want a foothold in Mexico’s growth story without going in blind.

On the flip side, being local in Mexico City keeps Nido grounded. The team can meet founders face-to-face, build relationships in the community, and source deals through trusted networks. (In fact, half of Nido’s deals are co-investments with U.S. investors, underscoring how they straddle ecosystems.) This boots-on-the-ground approach paid off when fundraising Fund I as well – despite starting in mid-2022 during a market downturn, Maria and Caro secured commitments in just 1–2 calls in many cases, thanks to years of relationship-building and a credible track record from their angel investing days.

In short, Nido’s cross-border strategy isn’t just a gimmick; it’s a competitive advantage. They can credibly sit in a boardroom in San Francisco and a factory in Monterrey and add value in both. That’s rare. And it means Nido’s portfolio companies get more than just a check – they get connectors who can open doors in both markets.

🚨 No More Copy-Paste VC: Adapting to LatAm Realities

A theme we’ve heard often on La Frontera is that you can’t copy-paste Silicon Valley’s playbook into Latin America and expect the same results. Maria wholeheartedly agrees. In fact, part of Nido’s thesis is that specialized local strategieswill outperform the old generalist approach.

One example: founder dilution. In Mexico, it’s common for founders to give away big chunks of equity early on (often well above 20% by Series A) because local capital was scarce and terms were steep. This can sap founder motivation and hinder companies later. Nido tries to combat this by writing smaller checks earlier (Pre-Seed/Seed) and then helping founders access more competitive (and sometimes international) follow-on funding so they aren’t forced to over-dilute.

Another difference: time to exit. The U.S. model assumes a 8–10+ year journey to an IPO or bust. But in LatAm, waiting a decade for the public markets might not be necessary (or wise). The rise of secondary transactions is creating earlier liquidity options. Growth-stage investors, from big international VCs to dedicated secondary funds, are eager to buy into promising LatAm startups around Series B/C – especially if they missed the initial rounds. For a fund like Nido, this means potentially selling a slice of their position in a winner to return capital early, while still holding equity for the long run. It’s a “have your cake and eat it” scenario that can de-risk portfolios.

Maria outlines three exit routes for early investors:

“One is secondaries, two is M&As, three is IPOs. We think we might actually get to go through the full cycle and see IPOs in our portfolio, which would be fantastic… but I think there’s been increased interest in secondaries in the region, and as a pre-seed investor there are scenarios where a Series C or D makes sense for me to exit.”

M.G. Peñaloza

In plain terms: keep the IPO dream alive, but plan for sales earlier if the opportunity arises. And LatAm’s exit environment is maturing – more tech giants and even traditional corporations are starting to acquire startups (e.g. Nubank’s recent fintech acquisitions). Nido suspects this M&A trend will grow as successful startups from the last 5–8 years become acquirers themselves, creating a virtuous cycle.

The key is flexibility. By not rigidly following a Silicon Valley script, Nido can craft outcomes that work for Latin America. That might mean selling a stake in a Series C to a Tiger Global or SoftBank-type entrant eager for exposure, or guiding a founder to an acquisition that keeps a company alive and well integrated into a larger player. A win is a win, and returning money to investors in 5 years instead of 12 is a win-win for an emerging fund building its reputation.

📊 Exits on the Horizon: Secondaries, M&A, and IPO Dreams

Speaking of exits, Maria shared a refreshingly optimistic outlook for the LatAm ecosystem’s future. Unlike a decade ago when the only path to liquidity was essentially “hope for an IPO,” today early investors have multiple shots on goal.

Nido expects that by the time their Fund I companies reach maturity, some will indeed go public – but even before then, more secondary exits will materialize. We’re already seeing dedicated Latin America secondary funds popping up, offering to buy portions of an early fund’s holdings or direct stakes from founders/employees. For pre-seed investors like Nido, this could mean returning the fund off a single big secondary sale if one of their startups becomes a regional champion by Series C. That’s powerful, because it proves the model and frees up capital to recycle into new startups.

At the same time, M&A is heating up. As the first generation of LatAm unicorns (think Nubank, Rappi, MercadoLibre, Kavak, etc.) mature, they’re starting to acquire smaller startups to fuel their growth or fill product gaps. And it’s not just tech companies – even family-owned conglomerates in industries like banking, telecom, or retail are realizing they need to buy innovation if they can’t build it. Maria notes that historically, LatAm M&A was limited because incumbents were old-school or slow-moving, but that’s changing fast as global competition and digital transformation force their hand.

All this means Nido’s founders have more options down the road. Instead of raising round after round waiting for a far-off IPO, a great startup could potentially get acquired in year 5 or 6 for a solid outcome. Or founders can take some chips off the table via secondaries to avoid extreme dilution and keep morale high. Nido, in turn, can show returns without abandoning the companies’ future upside.

It’s a balancing act, but Maria’s stance is clear: invest early, help companies grow, and be ready to seize liquidity opportunities when they arise. The days of “hold forever for the billion-dollar exit or bust” are over – and that’s a healthy evolution for Latin America’s venture scene.

(Fun fact: When asked if international investors are showing more interest in LatAm secondaries as a lower-risk entry point, Maria acknowledged some early signs. While most global investors still prefer primary rounds, a few have reached out about buying stakes later. So don’t be surprised if your Series B includes a secondary component—founders and early backers both can win.)

📣 ConteNIDO: Bridging Knowledge Gaps in Venture

Beyond investing, Maria and her team are on a mission to educate and inspire. Early on, they faced a surprising problem: even their own families didn’t understand what venture capital is! There was a lack of Spanish-language content explaining the startup/VC world. So Nido decided to fill that gap with a newsletter and content hub they named “ConteNIDO” (a play on contenido, Spanish for content, with a nod to Nido).

What began as a simple blog to demystify VC terms in Spanish has blossomed into a 13,000+ subscriber community of readers around the world. Initially, the goal was to help Latin Americans (like their parents!) grasp concepts like equity, fundraising, or tech trends. But as it grew, Maria realized ConteNIDO could also counter the skewed perceptions many outsiders have about Mexico.

“We noticed there was no content about VC in Spanish… We started by translating venture concepts for a local audience. Then we thought, a lot of what we want is to make sure the rest of the world understands Mexico. Realistically, you won’t reach them by only writing in Spanish. So we switched to English – ConteNIDO is about giving people around the world a better picture of what’s happening in Mexico, and how Mexico’s not what’s on Netflix, but what you see every day living here.”

M.G. Peñaloza

The result is a bilingual treasure trove of insights on Mexico’s tech scene – from explainers on nearshoring benefits, to profiles of up-and-coming Mexican startups, to analysis of policies affecting innovation. ConteNIDO has become required reading for many international investors evaluating LatAm opportunities (and apparently a few podcast hosts we know!). It’s also a smart marketing tool for Nido – showcasing their thought leadership and commitment to the ecosystem.

For Maria, however, the content initiative is personal. It’s about making tech and venture more accessible and inclusive. By writing in an approachable way and sharing knowledge freely, Nido is helping cultivate the next generation of founders and investors who will propel Mexico’s golden decade forward. The community feel is strong – people often reply to the newsletter with their own stories or questions, turning it into a two-way conversation.

In a region where trust and education lag in financial markets, ConteNIDO is a reminder that community-building can be as important as capital deployment. It’s not every VC firm that runs a mini-media arm on the side, but Nido’s doing it – and winning fans (and likely some deals) along the way.

Shoutout to our friend in CDMX, Jose Luis Sabau, the Editor and writer behind many enlightening ConteNIDO pieces!

📢 Listen to the full episode here.

Follow Maria Gutierrez Peñaloza, because why wouldn’t you want more updates from an investor-operator bridging two continents?

And check out Nido Ventures as they continue to back founders transforming legacy industries in LatAm.

Nido: Where startups find their wings

Thanks for reading!

If you enjoyed this newsletter, please consider sharing La Frontera 🌵 with your friends and colleagues. Let’s continue building a cross-border community of innovators! 🚀