Luis Andrés Enriquez Arias - GP, NAZCA

Podcast Notes, Episode 10 - Bridging the $1T Opportunity: Why Now Is the Time to Invest in LatAm

La Frontera 🌵 Podcast, Episode 10 - Bridging the $1T Opportunity: Why Now Is the Time to Invest in LatAm

Luis Andrés Enriquez Arias

In this episode, we sit down with Luis Enriquez, co-founder and GP of Bridge Latam, to explore why now is the moment to invest in Latin America's booming tech scene. Luis breaks down the $1 trillion opportunity, the industries primed for disruption, and how Mexico's cultural nuances shape startup culture. We also dive into the challenges (and opportunities) of Series B liquidity, secondaries, and founder over-dilution—key issues shaping the future of venture in the region.

From his 13-year journey building Cultura Colectiva into one of Mexico's largest digital media platforms (30M+ users, 60M+ social followers) to co-founding Bridge Latam, Luis brings a refreshing founder-turned-investor perspective to Latin America's evolving startup ecosystem.

We were introduced to Luis by a former Bridge associate, Fran Garcia, who also runs an awesome podcast called “Levantando.” Shout out to Fran! We knew we had to talk to Luis for his unique perspective and innovative investor mindset, especially after reading his original, published commentary on the startup ecosystem in LatAm. This conversation didn’t disappoint — it’s full of invaluable intel and learnings for investors and founders alike.

Episode 10 Summary

From Math Olympian to Media Mogul: Luis's journey from competing in International Math Olympics to building algorithms that predicted viral social media content—and scaling Cultura Colectiva to become the "Buzzfeed of Latin America."

The $1 Trillion Opportunity: Breaking down why LatAm's tech market cap (2% of GDP) has massive room to grow toward global standards—and what that means for investors.

Industries Ripe for Disruption: From telecommunications (where Mexico pays the highest data costs globally) to B2B financial credit and auto lending.

Bridge Latam's Thesis: How copying the US VC model doesn't work in LatAm, and how Bridge’s innovative approach leads to consistent returns.

Founder Dilution Crisis: Why LatAm founders are some of the most diluted in the world by Series A (above 15% average).

Cultural Barriers to Growth: How Mexican culture's stigma around failure is evolving with the help of former founders like Luis himself.

In Today's Newsletter

Bridge Latam: A Fund by Founders, for Founders

Note: Since recording this interview, Bridge Latam has completed a merger with NAZCA VC. We will cover the specifics of this monumental partnership in an episode next month. For now, please check out this article for more information.

💰 Assets Under Management: $15M+ (Fund 1, launched 2021) Recently merged with Nazca to combine $300M+ in assets

📍 HQ: Mexico City with operations across Latin America

🎯 Stage Focus: Pre-seed and Seed

🌎 Geographic Focus: Mexico to Argentina, including Brazil

📊 Check Size: $200K–$500K initial, with follow-on capacity

🏆 Portfolio: 30+ investments across Fund 1 & Fund 2

🚀 Notable Investments:

Aplazo lets users split any purchase into five biweekly payments with no credit card required.

Aptuno streamlines the home rental process in LatAm with tech-enabled, end-to-end service for both tenants and landlords.

Desteia uses specialized AI to automate cross-border trade, offering clean data, real-time freight tracking, and seamless customs handling.

EFEX is building a better cross-border payment solution tailored to the needs of small and mid-sized businesses in Latin America.

Elenas empowers women in LatAm to launch online businesses via a social commerce platform optimized for WhatsApp, Facebook, and more.

Hackmetrix offers the first comprehensive cybersecurity and compliance SaaS platform built specifically for LatAm SMEs.

Koywe provides a simple, reliable crypto on/off-ramp for LatAm businesses and users managing FX and blockchain transactions.

Kukun blends boutique hotel charm with the flexibility of short-term rentals to deliver immersive stays in Mexico.

Plenna is reimagining women’s healthcare in Mexico through tech-driven, personalized, and holistic health services.

Unique Model: Founder-led fund with unicorn founders as venture partners.

Exit Strategy: Focus on Series B secondary sales.

Learn more here: www.bridgelatam.com

🧠 From Math Olympiad to Missed Exit

Luis Enriquez didn’t set out to be a VC. He was a math prodigy who built algorithms before AI was cool—literally running social data through Excel to predict what would go viral. That hustle became Cultura Colectiva, a digital media company that skyrocketed to 60M followers and 30M monthly users.

Then came the first fork in the road.

“Televisa offered to acquire us for $25 million. I said no. That was a mistake.”

Luis Enriquez

Instead of cashing out, Luis took $5M in VC funding—at the same valuation. The company expanded into the U.S., but later hit major turbulence: a hacking incident, bad press, and a collapse in revenue that forced him to lay off 200 people.

That moment reshaped him. He lived the founder highs and very real lows. And it taught him two things:

The traditional VC model doesn’t always fit LatAm

Founders need other founders in their corner

So he teamed up with LatAm startup veterans to build Bridge Latam, one of the first institutional VC funds led by founders, for founders.

💰 The $1 Trillion Opportunity That Everyone's Missing

Luis' most compelling thesis centers on a stark data point: Latin America's tech companies represent only 2% of the region's GDP, compared to 70% in the US, 30% in China, and 20% in India.

"The thesis is that LatAm will go from 2% to 15% in the next 15 years. That opportunity is a $1 trillion opportunity of tech value generated in the region."

Luis Enriquez

The Math Behind the Opportunity:

LatAm GDP: ~$6 trillion

Current tech market cap: ~2% of GDP

Target: 15% of GDP (matching emerging market standards)

Potential value creation: $1 trillion

But what's driving this massive opportunity?

Three Key Factors:

1. Oligopolistic Market Structures: Industries like banking, telecommunications, and automotive are dominated by a few players, making disruption both necessary and highly rewarding to disruptors (i.e. NuBank)

2. Regional Homogeneity: Unlike India (20 languages, 13 religions), LatAm speaks primarily Spanish (with the exception of Brazil), shares Catholic heritage, and has similar colonial history—making regional expansion easier.

3. Asymmetric Information: Global investors see violence and narco-trafficking headlines, avoiding the perceived risk, resulting in less investor capital chasing opportunities in the region.

“I believe when you have this asymmetric information, then you have an under underserved market, and then every, dollar that you put here performs better than other regions.”

Luis Enriquez

🏗️ Industries Ready for Disruption

Part of Luis’ thesis of the opportunity in LatAm lies in the sheer number of huge, legacy industries with the potential to be disrupted. Not only that, but once you establish dominance in an industry, because of the oligopolistic nature of businesses there, you can create a moat for years to come.

Which industries does he think are the most ripe for disruption over the next 5-10 years?

1. Telecommunications

“For me, telecommunications for sure. I think in Mexico we pay the most amount of dollars per giga or per mega in data, and I can't have a phone call through internet if I'm in the street because it doesn't work.”

Luis Enriquez

2. B2B Financial Credit

Natural product-market fit for lending in the region

Some great consumer lending companies, like Monet

Several unicorns already emerging in B2B space

3. Automotive Industry

Both lending and selling sides ripe for disruption

KAVAK success story shows the potential

🚨 Why the US VC Model Breaks in LatAm

Despite the massive opportunity, Luis argues that even many local funds are going about investing the wrong way. Most LatAm funds copy the US playbook: invest in seed/Series A, hold for unicorn exits. Luis argues this is fundamentally flawed for the region.

The Problem:

LatAm gets only 1% of global VC money (should be 3.5% based on GDP)

No deep capital markets post-Series B

No local IPO markets (Mexico hasn't had an IPO in 5 years)

Requires 8-12 year hold periods for exits

Bridge's Hypothesis:

"What we believe is you have to Latin Americanize the VC model. You have to invest earlier, pre-seed almost all the money, and then start to get your money out in Series B."

Luis Enriquez

The Strategy:

1. Invest early: Pre-seed and seed rounds

2. Exit early: Sell secondaries at Series B when rounds are oversubscribed

3. Return capital fast: Investors see returns in 3-4 years instead of 10+

📈What happens when VC funds DO get it right in LatAm??

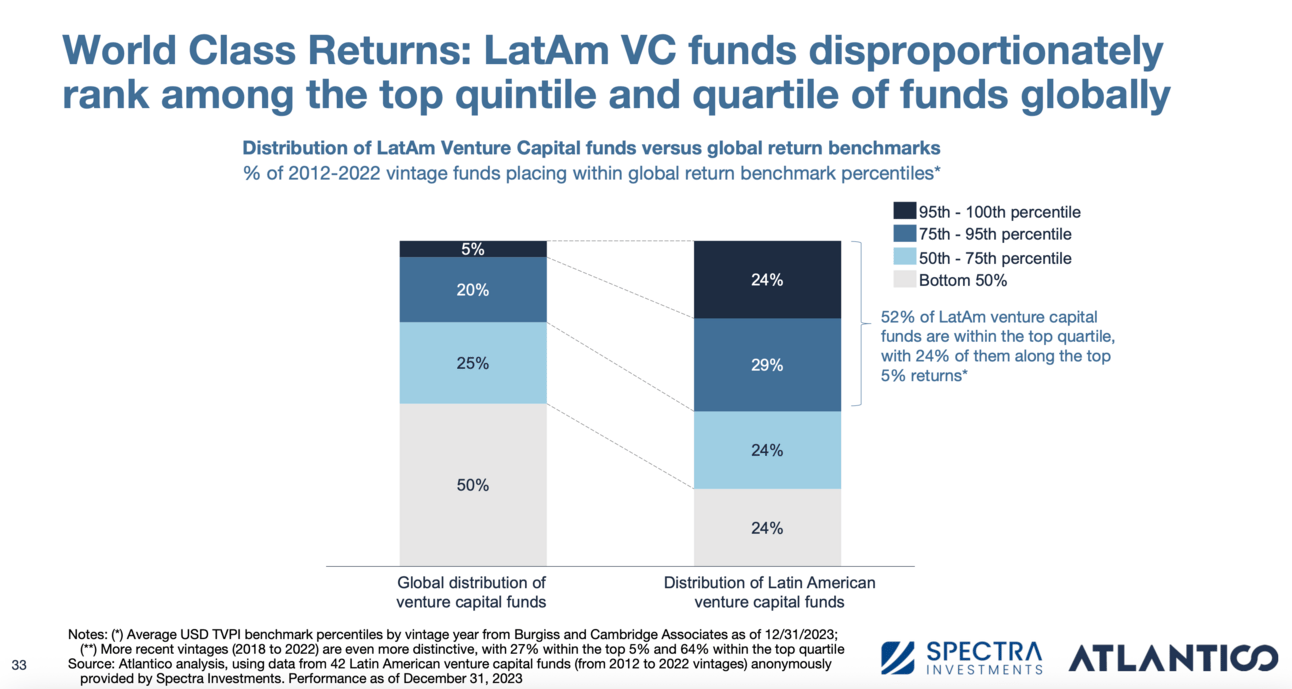

According to a 2024 report by Atlantico, VC funds in LatAm consistently outperform those of other regions, along with public investment benchmarks.

“If you get the best half of the funds in Latin America, they will be performing as the top quartile in the world.

This means that in general VC in LatAm outperforms VC worldwide. And then if you get the best quartile in LatAm, you'll be in the top decile worldwide.”

Luis Enriquez

Source: Atlantico 2024 LatAm Digital Transformation Report

🚀 Let’s double-click on Bridge’s series B exit model*:

Scarcity = Demand:

There aren’t many high-quality startups reaching Series B in Latin America. But when they do, they’re hot. These rounds are often oversubscribed.Growth Investors are Starved for Deals:

Growth-stage investors want in, but they have trouble securing allocations against big-name U.S. and regional funds (think Kaszek). That creates demand for secondary shares from early investors like Bridge.Founders Want Secondaries Too:

By Series B, LatAm founders are highly diluted (more than in other regions). They often push new investors to allocate some of the round to secondaries, giving Bridge a liquidity path.

Bridge isn’t doing this alone. Their LPs like this structure:

LPs get exposure to ~30 pre-seed bets via Bridge.

They know ~5 may make it to Series B.

Instead of chasing allocations with big growth funds, they can invest indirectly via Bridge, then get liquidity when Bridge exits via secondaries.

It’s like a free option—LPs get capital returned early, but still keep upside.

*Note: this strategy worked for smaller checks in Bridge’s angel syndicate structure — they’re still waiting to prove it out for larger investment sizes.

📊 The Founder Dilution Crisis

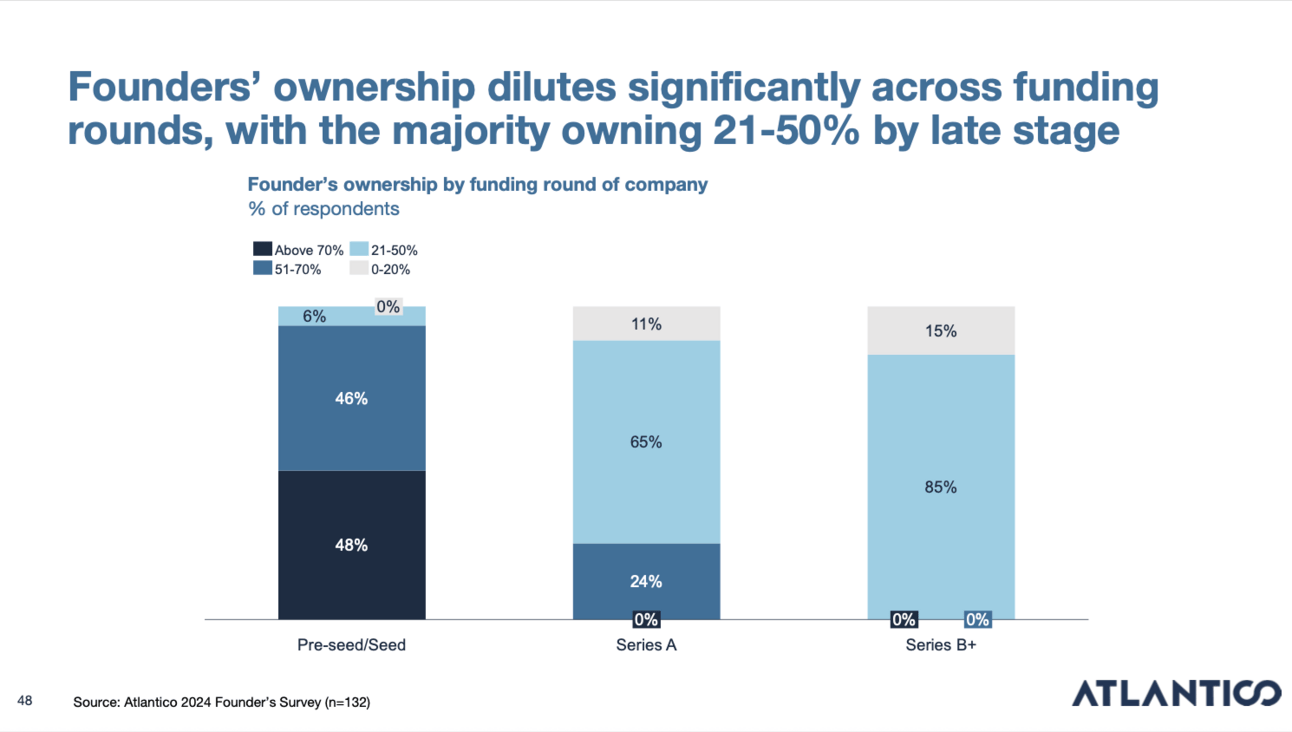

One of LatAm's biggest structural problems: founders are among the most diluted in the world by Series A, higher than the global average of 15%.

Why This Happens:

Most local funds focus on seed/Series A stages

Higher perceived risk leads to larger equity stakes

Limited competition among investors

The Secondary Solution:

"When Series B comes and a fund wants to put a lot of money, there's an incentive for founders to put a little bit of the money in secondaries because they don't want to get diluted anymore."

Luis Enriquez

This creates a win-win: founders reduce dilution, growth investors get access to competitive deals, and early-stage funds like Bridge can return capital to LPs.

👥 The Cultural Shift: From Failure Stigma to Founder Networks

Mexican culture traditionally discourages discussing failures, but that's changing rapidly.

“If you're having a bad time, you don't talk with anyone, you keep it to yourself. I mean, if you go to a psychologist, you're like a crazy person.”

Luis Enriquez

Kind of sounds like the Sopranos, doesn’t it? But Luis says this culture is changing.

The New Reality:

70% of Bridge's deals come from second-time founders (vs. 30% 5 years ago), and founder-to-founder mentorship networks are emerging with unicorn founders being active in the ecosystem.

Luis thinks empathy is crucial in advising founders. His experience as a founder and opening up and being vulnerable is a key tenant of Bridge’s value prop.

“When I tell my founder story to other founders, they see that I know how it feels to cut 200 people and everyone is screaming, I’ve felt that guilt, thinking because it was my fault, everything that happened.

So opening up and telling that to, to other founders, they open up as well and they actually tell me their worst fears. Then we get to the part where we help them address those fears.”

Luis Enriquez

🤝 Founders Backing Founders: Bridge’s Secret Sauce

Bridge isn’t just another VC fund—it’s a collective of builders. When Luis and his partners launched their first institutional fund, they didn’t follow the typical “venture partner” playbook. They flipped the model.

“Instead of giving a carry slice per deal, like most venture partner structures, we give a slice of the entire fund—but only to partners who commit real skin in the game.”

Luis Enriquez

Bridge's Founder Network:

The fund's venture partners include active executives who provide real-time advice:

Daniel Vogel (Bitso CEO) for crypto/fintech

Federico Ranero (former Kavak COO) for marketplace dynamics

Eduardo Paulsen (Ben & Frank CEO) for consumer brands'

Here’s how the Bridge model works:

Exclusivity:

Bridge’s unicorn founders must share all deal flow first with Bridge. No side investing. No cherry-picking.

Founder-led Due Diligence:

When a crypto startup pitches Bridge, it’s not just an analyst on the call—it’s Daniel Vogel, CEO of Bitso, asking the tough questions. That’s real operator insight—not spreadsheet vetting.

Skin in the Game:

Founders don’t just show up—they invest. Bridge GPs put in 7% of the fund’s capital (vs. 1–2% at most funds).

Hands-On Help:

Every founder contributes 2–4 hours/month to support the portfolio. And it pays off.

“One crypto startup lost all its bank accounts overnight. Bitso had just been through the same. Daniel stepped in, gave the founder a playbook, and solved the crisis in days.”

Luis Enriquez

This isn’t VC theater. This is real-time problem-solving from people who’ve lived it—and that’s Bridge’s edge.

🌎 From Carlos Slim to David Vélez: LatAm’s Next Founder Generation Is Here

Something big is shifting in Latin America—and it’s not just macro trends. It’s mindset.

“Today, 49% of university students in LatAm want to start a company. Just a few years ago, it was under 20%.”

Luis Enriquez

That generational leap isn’t just statistical—it’s symbolic.

Young Latin Americans aren’t dreaming of becoming Carlos Slim, the region’s traditional business titan. They’re looking to David Vélez (Nubank), Simón Borrero (Rappi), and Federico Ranero (Kavak)—tech founders who scaled ideas into unicorns.

“These are their idols now. And they want to follow in their footsteps.”

Luis Enriquez

Luis sees this shift as the cultural foundation of a coming tech boom:

Second-time founders are launching new ventures with real playbooks.

First-time founders are starting younger, faster, and bolder.

Tech is becoming aspiration—not anomaly.

And the transformation isn’t just personal—it’s economic.

“20 years ago, the most valuable companies in the U.S. were oil & gas. Now they’re all tech. Brazil has Nubank. Argentina has MercadoLibre. But Mexico? Still stuck with the same top 10 from two decades ago. It’s only a matter of time.”

Luis Enriquez

That’s the opportunity—and the call to action.

Investing in LatAm VC today isn’t just a bet on startups—it’s a bet on a cultural and economic reinvention.

And for Luis, that makes it both a smart move and a meaningful one.

“Maybe it’s a romantic way to think about the ecosystem, but I really believe this: VC in LatAm is investing in a new future for the region.”

Luis Enriquez

The Bottom Line: Luis and Bridge Latam are betting that Latin America is entering its iPhone moment—where existing infrastructure and talent converge with new technologies to create exponential value. For investors willing to understand the regional nuances and adapt their strategies accordingly, the $1 trillion opportunity isn't just a projection—it's an inevitability.

📢 Listen to the full episode here.

Follow Luis, because why wouldn’t you?

And check out Bridge & NAZCA as they continue to invest in and support Latin founders.

Thanks for reading!

Be sure to share La Frontera with your network if you enjoy our newsletters!