La Frontera 🌵 Deep Dive: Hitchhiker's Guide to Investing in LatAm

Latin America's Startup Scene in 2025: Resilient, Redefined, and Ready🚀

Iguazu Falls, Brazil by Chris Schmid

Learning about a new region can feel overwhelming. So we thought it would be helpful to start with some broad context around the startup and VC ecosystem in Latin America (LatAm).

In this new series (we’re calling them “Deep Dives”), we’re combing through sources and data from all of the newest reports. This will be our first post in the series covering EVERY major hub in LatAm, from Brazil to Peru.

Enjoy!

— Cyrus & Tom

In Today's Newsletter

Latin America's Startup Scene in 2025: Resilient, Redefined, and Ready 🚀

Over the last decade, Latin America’s tech ecosystem has been through a wild ride. From under-the-radar to red-hot, from boom to bust — and now, in 2025, into a new era of resilience and focus.

In 2015, tech optimists believed Latin America was about to "follow the Silicon Valley playbook": massive VC inflows, IPO waves, and global tech dominance. Instead, the region forged its own distinct path. Today, Latin America's startup scene is deeper, stronger, and more diversified than ever — but it’s also operating under new rules: 🧠 capital efficiency over blitzscaling, 🛠️ cross-country playbooks over single-market domination, and ⚡ AI-fueled innovation over pure replication models.

So, where do things stand now? What opportunities lie ahead? And what challenges still need to be solved?

🌎 Latin America’s Tech Journey: A Quick Recap

Two decades ago, Latin America’s startup world barely existed. Companies like MercadoLibre (founded 1999) and Despegar (founded 1999) were rare early survivors. VC funding was minimal, local ecosystems were fragmented, and global investors mostly ignored the region.

But by the early 2010s, things started to shift:

Mobile internet adoption exploded 📱

Middle-class growth created new consumer demand 📈

Early funds like Kaszek and 500 Global (check out our convo with René from 500) and accelerators like Start-Up Chile started nurturing talent 🌱

The inflection point?

In 2019, SoftBank’s $5 billion Latin America Fund turbocharged capital inflows. Global VCs like Sequoia, a16z, and QED swooped in.

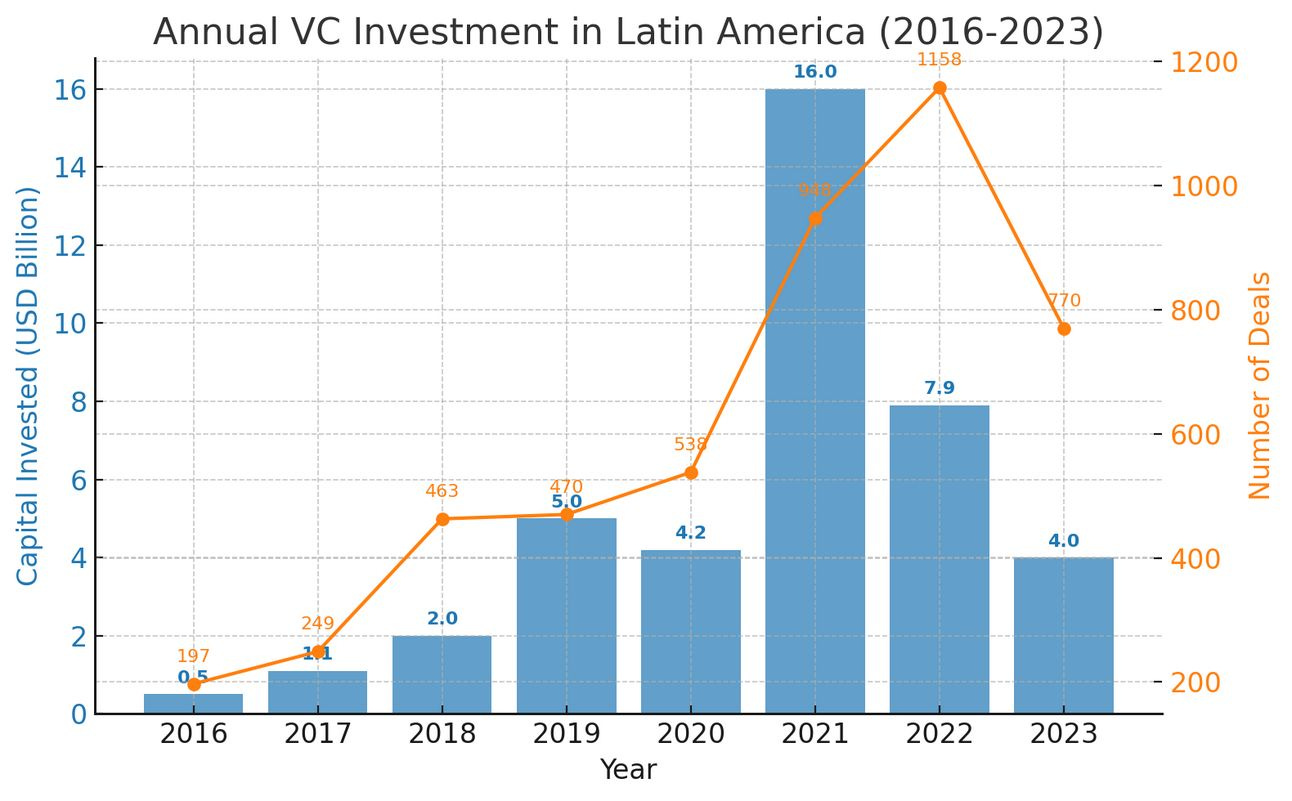

By 2021, Latin America had its "gold rush moment": VC investment hit a record $16B, startups like Nubank IPO’ed, and unicorns seemed to pop up weekly.

And then?

Global interest rates soared. Tech valuations crashed. Capital retreated. Latin America’s startup dream didn’t die — but it had to adapt.

🔥 Why Latin America Still Excites in 2025

Today, Latin America offers one of the most exciting emerging tech opportunities globally. Why?

Massive Market: 660M people, 70% internet penetration, 400M+ smartphone users. For context, the United States has 347M people, 92% internet penetration, and 310M+ smartphone users.

Underpenetrated Services: 45% remain underbanked. Huge gaps in healthcare, education, logistics, and retail.

Digital Acceleration: COVID forced mass digitization. Behavioral shifts stuck.

Talent Explosion: A generation of founders and operators now have real "at scale" experience (think Rappi, Kavak, dLocal).

AI Leapfrogging: AI adoption rates in LatAm now outpace Europe and North America for developers.

In short: Latin America has evolved from "copy Silicon Valley" to solve real-world problems, locally and profitably. This is HUGE.

💰 Venture Capital in LatAm: The 2025 Reality Check

After the party of 2021, Latin America’s VC landscape had to sober up fast. In 2022–2023, investment volumes fell by 70% from the peak.

Today, in 2025, things have stabilized — and in many ways, matured.

2024 VC funding: ~$4.2B deployed across ~800 deals — steady compared to 2023.

Seed and Early-Stage Dominance: 43% of deals in 2024 were at seed or Series A.

Venture Debt Rising: Debt financing made up 22% of startup capital — lifeline for growth-stage players like Pomelo and Jeeves.

Big takeaway: Latin American founders have gotten leaner, scrappier, and savvier. Investors are back, but only for startups with capital-efficient growth and a clear path to profitability. 🚀

🧩 Sector Breakdown: Where the Money is Flowing

Fintech: Still the heavyweight, grabbing 46% of 2024 VC dollars. Think next-gen payments, B2B finance infra, lending automation. (Check out our interview with Valentina from Vaas, who is building private debt infra for LatAm)

Proptech: Surprising second — about 7% of funding. Urbanization, logistics, and real estate innovation booming.

AI + Automation: Fastest-growing sector 🌟. 55+ AI-focused deals in 2024 alone, across customer service, agtech, healthtech.

Cleantech: A dark horse. With energy volatility and climate shifts, solar, wind, and energy storage startups are drawing serious interest (Pachama, Lemon Energy).

Logistics: Powered by nearshoring trends, especially in Mexico.

(Example: startups helping companies relocate manufacturing closer to the U.S.)

🌎 Future Hotspots: AI tools for LatAm languages, B2B fintech infra, climate resilience tech (energy storage, water conservation), regional logistics.

🗺️ Country-by-Country: Where Ecosystems Stand in 2025

Country

2024 VC Funding ($)

Highlights

🇧🇷 Brazil

$2.3B

Still ~50% of all LatAm funding. Strong fintech, SaaS, cleantech.

🇲🇽 Mexico

$1.1B

Rising star. Benefiting from nearshoring boom. Hot in logistics, B2B fintech.

🇨🇴 Colombia

$400M

Strong entrepreneurial wave. Fintech + delivery innovation continues.

🇨🇱 Chile

$240M

Consistent seed-stage hub. Edtech, healthtech growing.

🇦🇷 Argentina

$70M

Talent rich but macro still tough. Most startups incorporate abroad.

🔎 Key regional insight:

Brazil = standalone scale (you can build a unicorn inside Brazil alone: iFood, QuintoAndar).

Spanish-speaking LatAm = cross-border scaling needed (startups must win 3–5 markets to reach unicorn status: Rappi, Kavak).

Check out our interview with Alejandro Troll of BVC, who has special insights into the differences between building/investing in Brazil vs. Spanish-speaking LatAm.

In Latin America, the biggest winners don’t just win — they endure.

Let’s look at two case studies that show why:

🏆 Case Study: Why Giants Like MercadoLibre and Nubank Dominate for Decades

🛒 MercadoLibre: From E-Commerce to Everything

Founded in 1999, MercadoLibre is often dubbed the "Amazon + PayPal + UPS" of Latin America.

But its real magic lies in building deep, hard-to-replicate infrastructure:

Payments: Created MercadoPago to solve the lack of credit cards and safe online payment options.

Logistics: Built MercadoEnvios, its own shipping network, in regions with unreliable postal services.

Fintech: Expanded into loans, savings, and even launched Meli Dólar — a digital dollar stablecoin to shield users from currency devaluation.

By controlling payments, logistics, and credit, MercadoLibre created a self-reinforcing flywheel few competitors can break.

Today, it’s one of the most valuable companies in LatAm with a market cap of $112 billion, and still growing fast across 18 countries. 🛒✨

🏦 Nubank: The Neobank That Ate Traditional Banking

Founded in 2013 in São Paulo, Nubank did something radical: made banking lovable.

Offered a sleek, no-fee digital credit card in a market infamous for bad service and high fees.

Grew to 70M+ customers across Brazil, Mexico, and Colombia.

Expanded into savings, loans, insurance, investments — all through a single app.

Nubank IPO’d in late 2021 at a $41B valuation. Today, it’s expanding into the U.S. market — aiming to export its winning formula globally.

Key to Nubank’s success: relentless focus on customer experience, brand trust, and launching new products early (now 4+ products per customer on average).

🧠 Why Winners Last Longer in Latin America

Structural Challenges Create Moats: Solving payments, logistics, and trust in LatAm isn't easy. Those who succeed build deep defensibility.

Slow-Moving Competitors: Traditional incumbents are often inefficient, bureaucratic, and slow to adopt tech.

High Friction Means High Loyalty: Once a startup solves a problem well, customers rarely churn. Trust is everything.

Regional Complexity: Expanding across Latin America is tough (regulations, culture, currencies). Companies that master it early (like MercadoLibre and dLocal) win massive advantages.

🌎 In short: LatAm startups that break through aren’t just lucky — they’re battle-tested, adaptable, and insanely resilient.

🌟 The Rise of Entrepreneurship Across Latin America

The most powerful shift over the last decade?

Entrepreneurship is now part of the culture.

In the 2000s, startups were rare and risky. Today, founders are everywhere — building companies from Bogotá to Buenos Aires, Guadalajara to Santiago.

Key drivers:

Role Models: Founders like David Vélez (Nubank), Simón Borrero (Rappi), and Pierpaolo Barbieri (Ualá) showed it’s possible.

Talent Recycling: Ex-MercadoLibre and Rappi employees are starting their own ventures — a real “LatAm Mafia” effect.

Global Mindset: Founders today are building for regional or global scale from Day 1.

Support Ecosystem: Accelerators, venture studios, angel networks, and new VCs like Atlantico, Maya Capital, and Latitud are helping founders at every stage.

🌱 In short: the startup muscle is getting stronger. And it’s fueling the next wave of breakout companies.

🤖 AI: Latin America’s Wild Card for 2025 and Beyond

AI isn’t just hype — it’s reshaping Latin America’s startup landscape already.

Stats you should know:

74% of LatAm developers use AI tools weekly — outpacing the U.S. and Europe! 🚀

Over 55 AI-focused deals closed in 2024 — from agtech computer vision to Spanish-language AI chatbots.

Companies like Kavak are already using AI to streamline customer service, credit scoring, and operations.

Emerging players to watch:

Saptiva AI — building Latin America’s GenAI infrastructure (check out our interview with their founder, Angel)

Fintoc — fintech infrastructure + AI risk modeling

Talisman AI — enterprise AI automation

Pomelo, Belvo, QiTech — B2B fintechs layering AI into payments, lending, and fraud prevention.

🌎 AI gives LatAm startups a rare chance to leapfrog slower incumbents — if they can integrate it smartly.

🛤️ What Needs to Happen to Keep the Momentum

To truly unlock the next decade of growth, Latin America must:

✅ Deepen Local Capital Pools: More venture funds, corporate VC, and pension fund involvement to back startups beyond seed.

✅ Build Better Scaling Playbooks: Especially for cross-country expansion in Spanish-speaking LatAm.

✅ Strengthen Exit Markets: IPOs and M&A need to be more viable pathways (not just in Brazil!).

✅ Invest in Talent: Training more engineers, product managers, and scaling leaders.

✅ Embrace Capital Efficiency: Profitable growth is now the norm, not the exception.

✅ Tackle Infrastructure Gaps: Better logistics, financial services, internet access in underserved areas.

💬 As one founder put it:

❝

"The first generation showed it was possible. Now the challenge is to build faster, smarter, and more sustainably."

🚀 Final Take: Latin America’s Tech Future Is Its Own Story

Latin America didn’t simply copy Silicon Valley or Southeast Asia.

It’s building its own model: capital-efficient, resilient, regionally savvy, and increasingly AI-powered.

For founders, investors, and ecosystem builders:

🔵 The opportunities are still massive.

🟠 The path is harder but clearer.

🟢 The next decade is up for grabs.

If you’re betting on Latin America — now is a better time than ever to double down. 🌎🚀

📚 Sources:

BBVA Latin America VC Report 2024

The Future of Latin America’s Tech Ecosystem (2025)

The Fintech Opportunity in Latin America (2024)

SVB Global Banking Reports (2025)

Contxto, PitchBook, Finsmes reports on 2024 deal flow

Thanks for reading!

Be sure to share La Frontera with your network if you enjoy our newsletters!