Cristobal Perdomo - GP, Wollef VC

Podcast Notes, Episode 1 - From LPs to Exits: Building a Top-Tier VC Fund in LatAm

La Frontera Podcast, Episode 1 - From LPs to Exits: Building a Top-Tier VC Fund in LatAm

Cristobal Perdomo

If there’s one thing that stands out about Cristobal Perdomo, co-founder and GP of Wollef VC, it’s his willingness to help those interested in venture capital. Whether it’s young professionals looking to break into the industry or foreign investors trying to navigate Latin America, he’s always open to sharing insights.

Episode 1 Summary

In our very first episode, we sit down with Crisobal to unpack what it takes to build and scale a top VC fund in Latin America. Cristobal shares how he raised his first fund, the key differences between LP bases in Mexico and other countries, and some advice for foreign investors looking to invest in LatAm. We also dive into the challenges of exits in LatAm, the role of IPOs and M&A in creating liquidity, and whether it’s still too early to truly judge the potential for long-term success of VC in the region.

Table of Contents

Wollef VC: Backing the Next Wave of LatAm Unicorns

💰 Assets Under Management: $180M

📈 Number of Funds: 3

🌎 Portfolio Companies: 43

🦄 Unicorns: 5

🏆 Exits: Conekta was their first, Nubank is their biggest (so far)

🚀 Prominent Investments:

Nubank 🦄 – The largest digital bank in Latin America.

Kavak 🦄 – Online platform for buying and selling used cars.

Konfío 🦄 – SME lending and financial solutions.

Ben & Frank – Direct-to-consumer eyewear brand.

Loft 🦄 – Digital real estate marketplace.

Zolvers – Platform connecting domestic workers with jobs.

Jeeves 🦄 – Corporate cards and expense management for startups.

Jüsto – Online grocery delivery service.

Wollef invests in Pre-Seed, Seed, and Series A rounds, often leading or co-leading investments to help founders navigate the early-stage growth journey. They are a generalist fund, investing in most sectors except for hardware, biotech, and crypto. They are a sterling example of a successful VC fund in LatAm.

“We are committed partners. We love rolling up our sleeves and putting to work our minds, our hearts, and our capital.

We believe in building long lasting relationships with the entrepreneurs we partner with. We are open-minded, new ideas are always welcome. We approach every day with passion and boldness, taking risks and acting innovatively.”

From Law to VC: Cristobal’s Path to Venture

Cristobal didn’t take the typical finance-to-VC route. He started a few businesses before law school, realized he hated practicing law, and decided that an MBA at Columbia was his way out. He was in business school during the dot-com boom, which sparked his interest in venture capital.

Fast forward to 2008, he moved to Argentina, a country with a thriving entrepreneurial culture—not out of choice, but necessity due to economic and political volatility.

He built a startup, connected with VCs, and noticed a pattern:

❌ VCs were too hierarchical, inefficient, and vague in their feedback to startups.

✅ When he started Wollef VC, he committed to doing things differently—giving quick no’s, precise feedback, and building strong relationships with founders.

If you talk to Cristobal, you’ll quickly realize he doesn’t beat around the bush and is quite candid providing his opinions. This is a key element of Wollef’s culture: if they are not interested in investing, they will provide that feedback and instead of ghosting a founder, may even help them source other potential investors who may be a better fit.

Raising Wollef’s First Fund: The Monterrey Effect

Raising a fund in 2013 was brutal. No one wanted to be the first investor. The breakthrough came when a family office agreed to write the first check in exchange for carry and an investment committee seat.

📍 99% of their first LPs were from Monterrey, Mexico—a city known for its meritocracy, entrepreneurial spirit, and community-driven investing.

Cristobal notes that Mexico City investors tended to be more focused on returns, while Monterrey investors admired risk-taking and were more open to investing in a new fund.

As Wollef scaled:

💰 Fund 2: Expanded to international investors (Latin America, Europe).

💰 Fund 3: Secured U.S. investors, especially family offices, who operate differently and more “professionally” than in Mexico, where there tends to be a lot more family involvement in decision-making, according to Crisobal.

Unlike most Mexican VC firms, which rely on multilateral money (IDB, IFC, government, pensions), Wollef’s LP base is primarily family offices, setting them apart in the ecosystem.

Understanding LPs and Angel Investing in LatAm

🌎 LP bases vary widely across Latin America:

Brazil: Deeper, more diverse investor base (pension funds, insurance firms, endowments).

Argentina & Colombia: Mostly family offices and individual investors.

Chile: Initially government-backed (Corfo), but shifting to family offices and multilateral money.

🚀 Angel investing in LatAm is still immature. Unlike in the U.S., where active angels write checks consistently, many LatAm angels invest once every few years and take a hands-off approach. Without many exits, the pipeline of experienced founder-turned-angels is still small.

How Foreign Investors Should Approach LatAm

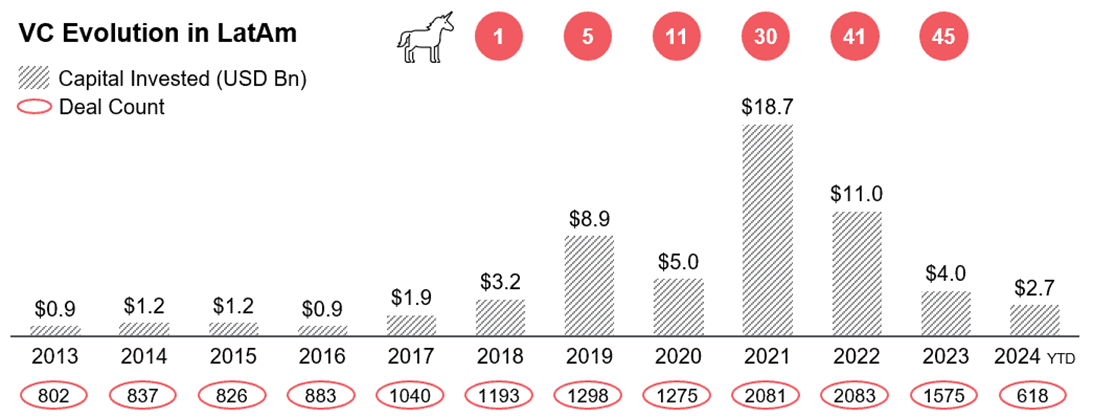

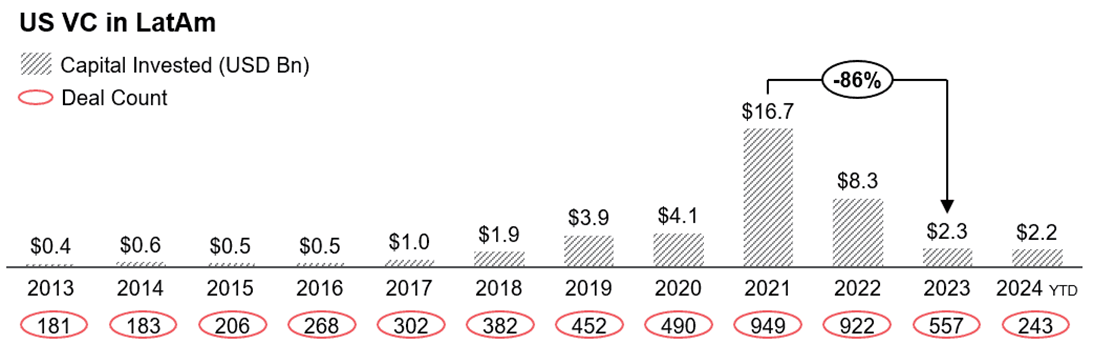

During the 2020-2022 VC frenzy, many U.S. firms rushed into LatAm—writing oversized checks with minimal due diligence. Cristobal is confident that most of those bets will likely fail.

The firms that get it right? They build strong local partnerships. A great example provided by Cristobal is QED Investors, which doesn’t have boots on the ground but collaborates closely with respected LatAm funds such as Wollef.

A key to success is staying humble. Every country has its own, distinct landscape and risks: a sound strategy can be formed to navigate each landscape, and local funds can provide unique insights and guidance.

For foreign investors looking at the region:

🔑 LatAm founders prioritize U.S. investors—local firms must fight for allocation.

📉 Setting realistic expectations on market size, regulation, and infrastructure is key to success.

The Exit Challenge in LatAm: The M&A & IPO Reality

💰 Exits remain the biggest challenge for VC in Latin America. Unlike in the U.S., where M&A is frequent, LatAm sees few large acquisitions.

In LatAm, companies valued over $500M are almost impossible to sell via M&A, but anything under $5B is unlikely to IPO in the U.S. This creates an immense valuation chasm. Most exits happen via secondary sales (selling early-stage stakes to later-stage investors), which offer opportunities to return invested capital to LPs, albeit at lower multiples.

For now, liquidity events will depend on IPOs in the U.S., as local stock markets lack depth for tech listings. Even Nubank eventually delisted in Brazil due to low liquidity.

📊 Wollef has exited Nubank (IPO) and done multiple partial exits via secondaries and acquisitions.

Final Thoughts: The Long-Term Bet on LatAm VC

Venture capital in Latin America is still early—most funds are only now completing their first cycle. The next 10-20 years will be crucial in determining whether the region can consistently generate high-quality exits.

Wollef remains focused on what they do best:

💡 Investing in fast-growing, high-margin businesses (sector agnostic)

🤝 Building deep founder relationships

📈 Backing companies that can withstand market volatility

In an industry where reputation and access matter more than heavy deal flow, Wollef continues to play the long game.

Follow Cristobal for more insights

Check out Cristobal’s podcast, Indie vs Unicornio, here:

indievsunicornio - Listen on YouTube, Spotify - Linktree

Thanks for reading!

Be sure to share La Frontera with your network if you enjoyed this episode!