Angel Cisneros - Founder & CEO, Saptiva

Podcast Notes, Episode 6 - From SMS King to AI Pioneer: Angel Cisneros on Bootstrapping, Exits, and LatAm’s Tech Evolution

La Frontera 🌵 Podcast, Episode 6 - From SMS King to AI Pioneer: Angel Cisneros on Bootstrapping, Exits, and LatAm’s Tech Evolution

Angel Cisneros

Angel Cisneros might not be a household name yet, but his journey embodies the evolution of Latin America’s tech ecosystem. In this episode of La Frontera 🌵, Angel shares how he bootstrapped an SMS startup in Mexico from scratch – again, zero outside capital – and eventually sold it to Silicon Valley giant Twilio. Now, as the founder of Saptiva, he’s on a mission to build Latin America’s own AI infrastructure, ensuring the isn’t just an AI consumer but also a creator. It’s a candid, founder-focused conversation packed with hard-won insights on building, scaling, and innovating in LatAm. (We encourage you to listen to the full episode – Angel’s perspectives are invaluable!)

Episode 6 Summary

Building and Exiting a Bootstrapped Startup in LatAm: How Angel built Quiubas Mobile in Mexico with no VC funding and led it to a successful acquisition.

Scaling in a Pre-VC Ecosystem in Mexico: The challenges of growing a tech company in the late 2000s when venture capital and startup culture were virtually non-existent in Mexico – and how that landscape has changed today.

Preparing a Startup for Acquisition: What it takes to position a company for an exit – from structuring and “cleaning up” the business to finding the right buyer (and why not all offers are equal).

Why LatAm Needs AI Infrastructure – and How Saptiva is Solving It: The vision behind Angel’s new startup, Saptiva, and why AI infrastructure is critical for Latin America’s future.

AI Investment in LatAm vs. the U.S.: A look at the funding gap and differing investor mindsets – why U.S. investors often lead in backing bold AI bets, and what that means for LatAm founders.

In Today's Newsletter

Saptiva: AI Infrastructure in Latin America

Saptiva is a pioneering startup building a decentralized, cloud-agnostic AI platform to empower Latin American enterprises. In a region that has mostly relied on foreign tech, Saptiva aims to provide local infrastructure so companies can develop and deploy AI solutions on their own terms – with local data control and without needing massive in-house hardware.

Founded: 2023

Stage: Early-stage (Pre-seed)

Total Funding Raised: Undisclosed

Investors: a16z Scout Fund, Magma Partners, 99 Startups, Semilla Ventures, Crucible Capital

Mission: To democratize AI in Latin America by building the “fundamentals” of AI locally – enabling the region to be more than just an AI consumer . In Angel’s words: “I see there’s a big opportunity for the fundamentals of AI in the region and not just [to] be an AI consumer region… we have the potential to do much more.”

🥾 Building and Exiting a Bootstrapped Startup in LatAm

Angel’s first startup story begins in an unlikely place – León, Guanajuato, an industrial city known for shoes, not software. In 2006, at a cousin’s wedding, Angel was struck by a simple problem: texting in Mexico was expensive. “My cousin… asked to borrow my phone to text… he had to wait for his allowance. At that time a text message was 75 cents, a phone call three pesos – it was expensive,” Angel recalls . As a 23-year-old software engineer, he had a crazy idea: what if we could send text messages for free over the internet? “Me being an engineer… I was like, okay, wouldn’t it be cool to have something that would allow you guys to intercommunicate for free?”

That spark led him to spend nights and weekends coding a solution on his parents’ desktop PC . By mid-2007, he had launched Quiubas Mobile – essentially a free SMS web app for students – unaware that he was at the start of a startup journey.

“Me being an engineer… I was like, okay, wouldn’t it be cool to have something that would allow you guys to intercommunicate for free?”

Angel Cisneros

Growing Quiubas in those early years meant grit over glamour. “There were no [funding] options at all,” Angel says of the 2007 environment. He had zero exposure to venture capital (“no idea about VCs or fundraising – I had no idea” ) and no family money to fall back on. So, he bootstrapped the company the hard way: juggling a day job while coding by night on a few hours of sleep. His family didn’t entirely grasp what he was building, but they cheered him on to “keep it going,” which was invaluable moral support. Over time, that side project grew into a real business. Quiubas evolved from a student SMS network into a B2B messaging platform, becoming a quiet success. In fact, it eventually became the largest messaging company in Mexico and Latin America – effectively making Angel the “SMS king” in Mexico.

Angel and his brother (his co-founder) built a profitable company without a single dollar of outside venture capital all the way until exit. “We never raised outside capital ever,” Angel notes proudly of that 13-year grind.

❝

We never raised outside capital.

Angel Cisneros

And the payoff? In September 2020, Twilio acquired Quiubas Mobile for an undisclosed sum. This was a landmark moment: a scrappy Mexican startup – founded in a pre-VC era – getting bought by a NYSE-listed cloud communications company. Angel’s long nights and persistence led to a life-changing exit (made even sweeter by the fact that, with no investors on the cap table, the founders retained most of the reward).

His story is a testament: you can build a Latin American startup to a meaningful exit through sheer bootstrapping – it’s hard, but he did it.

🚀 Scaling in a Pre-VC Ecosystem in Mexico

Building a tech company in Mexico in the late 2000s was like flying solo without a map. Venture capital was virtually nonexistent in the country at that time. In fact, according to AMEXCAP, “there was no venture capital activity in Mexico in 2007.”

Angel launched Quiubas into this void – a time when “startup” wasn’t part of the local vocabulary. He started the company in León, far from Mexico City’s business circles, in a region dominated by traditional industries. Culturally too, entrepreneurship wasn’t a typical path.

Angel jokes that Tecnológico de Monterrey (his alma mater) encouraged students to be business-minded, but “in a more traditional way” – the idea of a 20-something quitting a stable job to chase a tech startup was almost unheard of. Yet Angel did exactly that, he went all in on his startup, encouraged by his father’s advice: take the chance while you’re young. “If you fail… you’ll be 30, still very young to get a job. But don’t regret not taking the chance,” his father told him. That mindset gave Angel the courage to pursue Quiubas full-time in an era when most peers sought safe careers.

Today, the landscape in Mexico has changed dramatically. The “startup fever” that was absent in 2007 has since taken hold. Angel notes that back then he knew of almost no one trying to become a tech entrepreneur – it was a rarity. Now, a new generation is emerging.

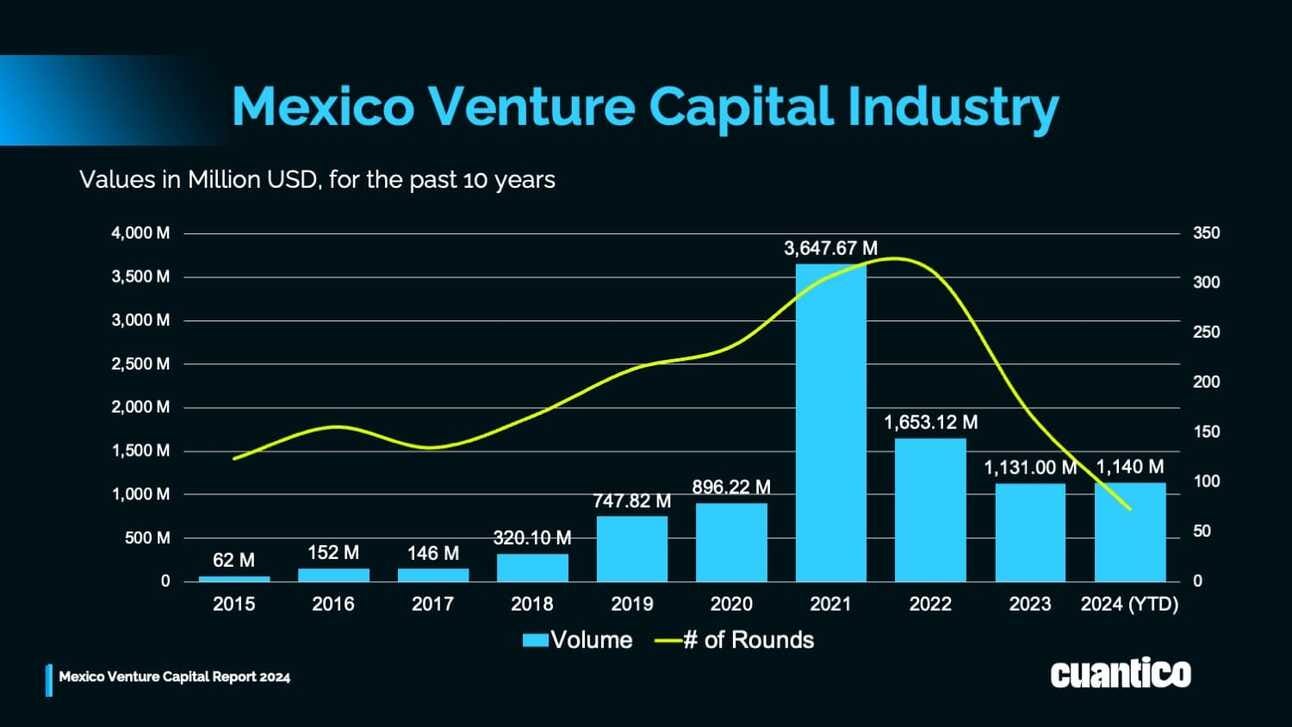

Venture capital investment in Mexico’s tech sector grew dramatically over the past decade, rising from virtually nothing in the mid-2010s to record highs by 2021. Source: Cuantico

The funding environment has also undergone a revolution. For the first several years of Quiubas, Angel simply could not have raised venture money even if he wanted to – the industry didn’t exist. But around 2011–2012, Mexico’s government and pioneers began seeding VC funds . By the mid-2010s, early successes like Clip and Konfío were breaking fundraising records and proving that Mexican startups could scale with investment.

The real boom came in 2019–2021: as global investors took notice of LatAm, capital flooded in. In 2020, venture investment in Mexican startups exploded despite the pandemic – and 2021 quickly surpassed 2020’s record. The chart above illustrates this meteoric rise: from just $62M in 2015, VC funding hit $3.6B+ by 2021.

For Angel, watching this evolution has been gratifying – if a bit ironic. He built Quiubas the old-school way because he had to. Now, new founders can tap into a growing network of local VCs and global funds that simply didn’t exist when he started. While capital is far more available now, Angel’s story underscores that resourcefulness and persistence remain core to startup success. And despite more money flowing, he believes that ambition is still a crucial differentiator. As he puts it, “if you can stay focused on a mission for 10+ years, through all the ups and downs, you can achieve something big” – a rare trait he’s tried to cultivate from Quiubas to Saptiva.

💰 Preparing a Startup for Acquisition

By the late 2010s, after a decade of running Quiubas, Angel began to sense that an exit opportunity might be on the horizon. Tech giants were expanding into LatAm, and Quiubas’s messaging platform was in a strategically valuable spot. In fact, Twilio – a global cloud communications company – had been using Quiubas as a client since 2016. Interest was brewing: “We had three other acquisition offers. Twilio was our client… so we kind of knew what we had on hand. We knew we had leverage,” Angel explains. Rather than jump at the first offer, he and his brother kept growing the business, mindful that the right acquirer could take what they’d built to the next level.

Still, when it came time to actually pursue a sale, Angel admits Quiubas wasn’t prepared in a formal sense. In 2019, Angel was introduced to an M&A advisor (Ariel Fischman of 414 Capital) who gave him a crash course in getting the startup’s house in order. Quiubas had been set up in a very bootstrapped way – their Mexican entity was an “S.C.” (a civil company) rather than a typical venture-friendly corporation. There were tangled corporate structures (a US LLC with no formal link to the Mexican operating company) and a lack of the documentation an acquirer would expect.

Realizing this could scare off buyers or reduce the deal value, Angel spent months restructuring and cleaning up the company. It was a crash course in exit readiness: from converting the legal entities to auditing financials and securing IP – tasks many VC-funded startups handle early, but a bootstrapped company might defer. “We built the company never with the intention to sell it… it wasn’t even structured to receive investment,” Angel says, highlighting how ad-hoc their setup was before this overhaul.

All that preparation paid off when Twilio officially came knocking. In early 2020, Angel met with Twilio executives in Madrid. That’s when he heard the magic words: “My department has submitted the request for Twilio to acquire Quiubas, because you are the only way to do what we want to do in LatAm.” Twilio had determined that acquiring Quiubas was the fastest path to bolster its Latin American network – a huge validation of what Angel’s team had built. The deal moved forward in the spring of 2020. Because Quiubas had other suitors and Twilio needed their tech, Angel felt he had a strong hand in negotiations (a founder’s dream scenario). Fortunately, it remained a friendly deal – Twilio was mission-driven to integrate Quiubas, not just shopping for a bargain. By September 2020, the acquisition was finalized, marking one of the notable cross-border tech exits that year.

Angel’s experience offers a mini playbook on preparing for an exit in LatAm:

Start early – even if you’re not looking to sell, keep your startup “clean” and structured as if you might (you never know who will come knocking).

Build relationships – Angel’s chance encounter with a banker friend was serendipitous but having advisors who understand M&A can be game-changing.

Leverage your strengths – Quiubas was indispensable to Twilio’s LatAm plans, which gave Angel leverage to negotiate a favorable deal (he wasn’t a desperate seller).

Choose the right acquirer – one that values what you’ve built.

Angel walked away happy that Twilio was committed to expanding on Quiubas’s foundation, not just absorbing it. The broader LatAm ecosystem also got a boost: Twilio’s purchase of Quiubas was part of a growing trend of global tech companies acquiring LatAm startups to accelerate their regional entry. That year saw a spike in Mexican startup exits – 18 VC-backed exits in the first three quarters of 2020, up from just 4 in 2019 – signaling that M&A is finally becoming a viable liquidity path for LatAm founders.

🤖 Why LatAm Needs AI Infrastructure and How Saptiva Is Building It

After exiting Quiubas and briefly exploring the VC world, Angel Cisneros felt the pull to build again. “Everybody wonders why I’m doing this… it’s hard enough to do one startup, why do a second one?” The answer was simple: he missed the adrenaline, but more importantly, he saw a gaping hole in LatAm’s tech stack—its lack of foundational AI infrastructure.

While the region is full of talented founders and growing AI use cases, most of the tools, compute, and models come from the U.S. or China. Angel believes this dependence will become a strategic liability. “LatAm doesn’t have the resources to build its own AI… I just cannot conceive why we have to be dependent on the U.S. or on OpenAI,” he explains.

That’s why he founded Saptiva, a company building decentralized AI infrastructure designed specifically for Latin America. Saptiva enables organizations to access AI computing power—whether it’s cloud, on-prem, or edge—without sending data abroad or investing in massive new hardware.

Saptiva’s model is not about building one more hyperscale data center. Instead, it stitches together the region’s fragmented infrastructure to make AI more accessible, efficient, and sovereign. This approach is especially relevant for banks, governments, and healthcare providers that require data to stay local due to security and regulatory concerns.

The need for regional AI capacity is only growing. Latin America’s data center market is projected to nearly double by 2030—from ~$7B to $14B—fueled by increased cloud adoption, data localization laws, and the rise of AI-native businesses.

Saptiva is also innovating at the model layer. On their platform, users can access multiple open-source models via a single API, with an option to deploy locally. They’ve even built a LatAm-specific image generation model fine-tuned for Spanish and regional cultural nuance—proof of their thesis that global AI tools aren’t always built with local users in mind.

And while investors in the U.S. have responded enthusiastically, Angel notes that some LatAm investors are still hesitant.

“The angel investors that have perceived what’s happening—the AI revolution—are the investors from the U.S., not from LatAm.”

Angel Cisneros

Saptiva’s long-term goal isn’t just about infrastructure—it’s about independence. In Angel’s view, the next wave of globally competitive AI companies will be those that control their own stack. Saptiva aims to give Latin America the building blocks it needs to compete—on its own terms.

🤔 AI Investment in LatAm vs the U.S

When Angel Cisneros set out to raise capital for Saptiva, a pattern quickly emerged: the most enthusiastic backers weren’t in Latin America—they were in the United States.

“The investors that have perceived what’s happening—the AI revolution—are from the U.S., not from LatAm.”

Angel Cisneros

Despite the region’s urgent need for AI infrastructure, Latin American investors often shy away from deep tech bets. Angel recalls being told by local VCs, “This is super risky and super ambitious—but if someone can do it, it’s you.” A kind nod, but not a check.

This cautious approach is reflected in funding statistics. In 2024, global venture capital investment in AI startups soared to $131.5 billion, marking a 52% increase from the previous year. Notably, North America accounted for nearly 60% of this investment, underscoring the region’s dominance in AI funding, with China and Europe accounting for most of the remaining 40%.

In contrast, Latin America’s total venture capital funding across all sectors was significantly lower. In 2023, the region attracted approximately $2.9 billion, a sharp decline from previous years . Although there was a modest recovery in 2024, with funding reaching $4.2 billion, the gap remains substantial.

That’s why Angel leaned on early backing from the U.S. and crypto/AI communities to get Saptiva started. But he’s clear: LatAm can’t afford to sit on the sidelines. Without homegrown support, the region risks deepening its dependence on external infrastructure.

Momentum is building across Latin America. Brazil, home to the majority of the region’s AI startups, is experiencing significant investor activity. The country’s AI market is projected to grow from $3 billion in 2023 to $11.6 billion by 2030. Meanwhile, Chile has launched a national AI policy and introduced an AI bill focused on ethical and responsible development of the technology . Uruguay has also approved a revised national AI strategy for 2024–2030, aiming to promote the development and use of AI in both public and private sectors .

Angel’s goal is to be a catalyst—not just by building Saptiva, but by inviting more Latin American stakeholders into the fold.

❝

If you’re excited about building Latin America’s AI future—reach out.

Angel Cisneros

🔑 Final Takeaways

Bootstrapping Can Win

Angel built and exited Quiubas with no outside capital—just relentless focus, long nights, and a deep belief in solving a real problem. His story proves that resilience and scrappiness still go a long way in LatAm.

LatAm’s Ecosystem Has Evolved

In 2007, VC in Mexico barely existed. Today, the region is flooded with startup activity and funding. The culture has shifted—and the path Angel helped pioneer is now a viable track for the next generation.

Be Exit-Ready Early

Even if you’re not thinking about an acquisition, structure matters. Angel had to restructure Quiubas to meet Twilio’s standards—proof that being organized from day one can pay off when opportunity knocks.

Deep Tech Is the New Frontier

Saptiva reflects a bigger trend: LatAm founders are moving beyond proven models to tackle infrastructure-level problems. The region has the talent—it just needs the tools and ambition to build globally competitive tech.

The Funding Gap Remains

U.S. investors are leading the charge on bold AI bets. LatAm needs more risk-tolerant capital to back its biggest ideas. Until then, founders will keep bridging the gap—and proving it’s possible to build globally from the region.

📢 Listen to the full episode here.

Follow Angel, because why wouldn’t you?

And check out Saptiva to see if it’s something your team can benefit from.

Saptiva: AI Infrastructure and Orchestration for LatAm

Thanks for reading!

Be sure to share La Frontera with your network if you enjoy our newsletters!