Andrés Londoño Botero - Co-Founder & CFO, Monet

Podcast Notes, Episode 9 - Open Banking for the People: Redefining Credit Access in Colombia

La Frontera 🌵 Podcast, Episode 9 - Open Banking for the People: Redefining Credit Access in Colombia

Andrés Londoño Botero

We first met Andrés last summer in Bogota during Colombia Tech Week as we were on a shuttle (courtesy of the folks at Wagon) on the way to Daniel's finca (a finca is a farm or estate for our non-Spanish speaking friends) for a fun get-together to close out an incredible Tech Week.

Andrés was sitting in front of Cyrus and as they were talking, Cyrus mentioned the podcast. Nine months later, we’re excited to finally make this episode happen, especially after Monet hit major milestones recently!

A little announcement before we dive in…

🎉 We are hosting our FIRST EVER EVENT during NY Tech Week (June 2-6)!

Come join us for a cup of coffee ☕️ (provided by Bright Cup Coffee), some light bites, and good conversations. RSVP via the Partiful link below 👇 and make sure to share this with your friends and network. Let’s make this HUGE 🙌

Series B(ean): an IRL Coffee Chat for Founders, Angels, and VCs - #NYTechWeek

La Frontera 🌵 is partnering up with Pygma to bring you delicious Colombian coffee and light bites. Come mingle with other Founders, Angels, and VCs!

partiful.com/e/t66e31CfpDvqWnLfhwTz

Episode 9 Summary

🔁 From Public Sector to Payday Pivot – How a government economist became a fintech founder and why Monet's original payroll model didn’t scale.

💸 First Loan, First Chance – Why Monet focuses on giving first-time borrowers access to credit—and how they built trust in a segment banks ignore.

📊 Scoring the Invisible – With 350+ behavioral features and no credit bureau data, Monet built its own ML credit model from scratch.

🌍 Why LatAm, Why Now – Andrés Londoño explains why half of LatAm adults still can’t get credit—and how Monet is filling that gap.

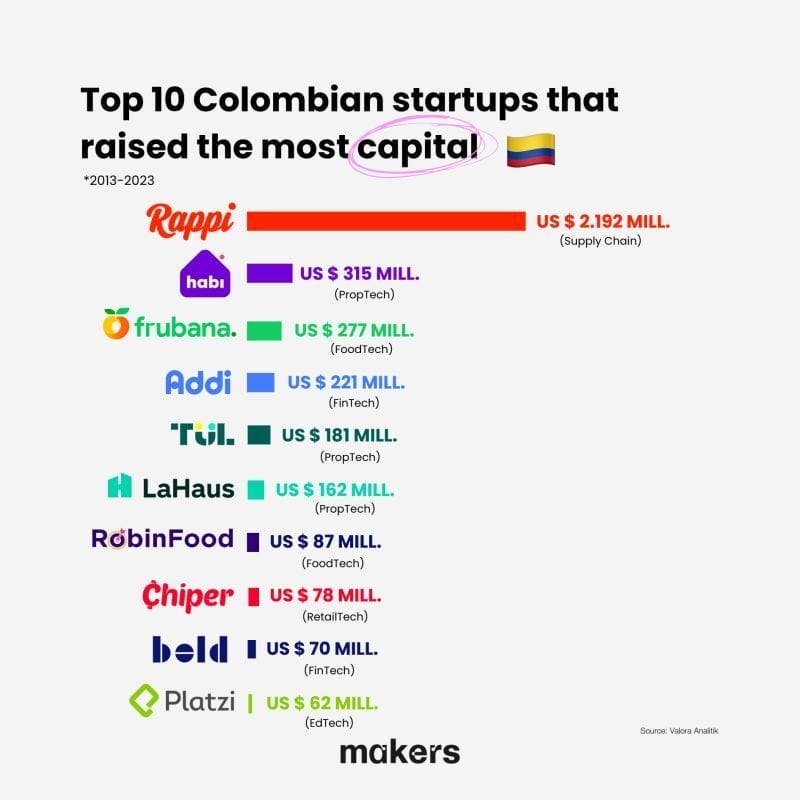

🇨🇴 Colombia’s Startup Moment – The rise of fintech, policy tailwinds, and why Andrés believes Colombia is ready for breakout success.

💥 YC, Valuations & the Venture Squeeze – What Andrés learned from fundraising during the 2021 boom, and why Monet’s cap table now leans international.

In Today's Newsletter

Monet: Credit Access for the 99%

🚀 Founded: 2020 in Colombia

📈 Stage: Series A

💰 Total Funding Raised: Over $10M (equity and debt)

🤝 Investors: Y Combinator (S21), K5, River Side Ventures, and others

🎯 Mission: To democratize access to fair, fast credit in Latin America by leveraging data and technology to serve the financially invisible.

Monet is a Colombian fintech company that provides instant, interest-free cash advances to underbanked consumers with recurring income, including gig workers, freelancers, and those with poor or no credit history. In a market where traditional lenders often overlook large segments of the population, Monet uses open banking data and AI to assess risk based on real-time transactional behavior rather than outdated credit scores. Users can request loans in seconds, with disbursements typically ranging from 50,000 to 500,000 COP, helping them manage urgent liquidity needs without falling into predatory lending cycles.

🎓 From Public Policy to Payroll Lending

Andrés didn’t start in startups — he thought he wanted to be a politician.

“I studied economics, then got a master's in public policy, another in regional development. I thought I was going to work on economic inequality through the public sector.”

Andrés Londoño Botero

He spent four years in government, working at Colombia’s Ministry of Finance and DIAN, the national tax authority. That gave him an inside look at how formal systems worked — or didn’t.

But like many LatAm founders, it was a chance conversation that sparked his pivot into tech.

“I met Leonardo, now our CEO, through a mutual friend. We clicked right away. I brought in my cousin as our third cofounder. We started exploring an idea that was completely different.”

Andrés Londoño Botero

🧁 The Founding Story: Not a Straight Line

Monet didn’t start as an open banking company.

The first version of Monet was modeled after U.S. earned wage access products — essentially payday loans tied to payroll that were repaid via automatic salary deductions. While the concept made sense, it proved unscalable in the Latin American context for several reasons:

Employer-by-employer integration: Each partnership required negotiating directly with employers.

Fragmented HR systems: Many companies used legacy or non-cloud-based HR software, making integrations complex or impossible.

Limited reach: The model excluded informal workers, freelancers, and gig economy participants — a huge share of the LatAm workforce.

“You have to negotiate with every employer… and many HR systems had no cloud infrastructure. Connecting was impossible.”

Andrés Londoño Botero

The two co-founders pivoted. Today, Monet offers short-term, interest-free loans ranging from 50,000 to 500,000 COP — typically to first-time borrowers who can’t access traditional credit.

"You can apply in seconds. If you’re approved, the money hits your account right away. There’s no interest — just a small flat fee. And we structure the repayment to match their income flow."

Andrés Londoño Botero

They’ve already granted well over one million dollars in loans and served more than 700,000 customers, building traction in a demographic most lenders ignore.

In 2021, Monet launched a digital wallet with the BaaS model, in partnership with Bancolombia, connected to current and savings accounts, which allows using Bancolombia QR codes to make purchases and check balances.

Colombian credit fintech Monet looks to expand into Central America

Continue reading to figure out how they got there… 🤔

🧬 How It Works: Open Banking + Behavior-Based Risk

Monet combines in-house infrastructure with third-party APIs like Belvo to access users' bank accounts and digital wallets. Instead of relying on credit scores or HR data, Monet evaluates real-time financial activity to underwrite loans — especially for customers with no formal credit history.

Every loan is underwritten based on:

📊 Recurring income patterns — gig economy payouts, informal business earnings, or other detectable inflows.

💸 Cash flow health — including balance trends, volatility, and buffer days.

🧾 Spending behavior — categorized expenses help assess affordability and financial discipline.

🛑 Early fraud or anomaly signals — pattern breaks or new device/account behavior.

“Defaults were higher in the beginning. But now we’ve stabilized losses, even in months like January or mid-July where seasonal factors weigh in. The key was learning how people behave.”

Andrés Londoño Botero

📈 Building Credit Models on Real Data

Monet recognized a gap in relying on data from traditional credit bureaus in Colombia — only about 30% of their target users would have been eligible for loans. Their users are often thin-file or invisible to existing systems, and credit bureaus don’t capture real-time behavior: Bureau data lacks transactional detail on income flow, spending, and liquidity patterns — especially critical for small, short-term loans. Unfortunately, Moffin is not yet operating in Colombia 😉 (click here to read about how Moffin is building data infrastructure for credit providers in Mexico).

Understanding this, Monet built an internal scoring system powered by machine learning and open finance data.

Using their large loan book, Monet developed a probabilistic model trained on over 350 features, including:

Account balances, inflows/outflows, and transaction types

Behavioral activity over time (e.g., salary patterns, payment habits)

Enriched insights from categorized financial data

The model was trained using XGBoost and validated with AUC and KS metrics, delivering a 20%+ reduction in defaults.

“The credit market in LatAm is almost infinite — and the supply of credit solutions is nowhere close to meeting it.”

Andrés Londoño Botero

🌎 Lending in Latin America: An Underserved Giant

Why build a lending company in LatAm? Because the opportunity is massive and the potential for positive social impact is equally vast.

“More than half of adults in Mexico and Colombia have never had access to formal credit.”

Andrés Londoño Botero

Traditional lenders are conservative, slow, and data-poor. Most won’t even consider gig economy workers — even if they get paid weekly.

“If you drive for Uber in Bogotá, a bank doesn’t consider that formal income. You can’t even open an account.”

Andrés Londoño Botero

Andrés believes this isn’t just a social problem, it’s an economic one. Informal workers, like any small business, need working capital to grow.

❝

“We want to be the first loan someone ever receives. That’s the biggest opportunity.”

Andrés Londoño Botero

By targeting unbanked and underbanked users, Monet avoids direct competition with banks who are focused on prime borrowers in a high-rate environment.

What are the factors making digital lending products successful in LatAm?

Open finance frameworks (e.g., Mexico’s Fintech Law, Brazil’s Open Finance initiative) are expanding access to financial data.

Widespread smartphone usage enables real-time credit products tailored to behavioral data — not traditional scores.

Digital wallets (like Nequi in Colombia or Mercado Pago in Argentina) create infrastructure for instant disbursements and repayments.

Governments increasingly support fintech innovation to improve financial access.

Associations like Colombia’s FinTech Association advocate for friendly regulation and infrastructure development.

💸 Fundraising and the YC Effect

Monet went through Y Combinator in Summer 2021, during the peak of the LatAm fintech boom.

✅ Positives of Y Combinator for Monet

Global Credibility – YC gave Monet instant exposure and validation, making it easier to raise capital (over 90% of seed investors were international).

Access to a Top-Tier Network – Introduced Monet to a strong ecosystem of founders, operators, and potential partners.

Execution Discipline – YC helped sharpen their focus on KPIs, go-to-market strategy, and rapid iteration.

Signal to the Market – Being a YC company gave Monet stronger leverage with investors, talent, and collaborators.

Fundraising Momentum – YC branding helped accelerate their seed round coming out of the program.

“YC was amazing. Great exposure, great network. The only downside is valuation.”

Andrés Londoño Botero

He’s referring to the standard YC push to raise at high valuations, which did backfire on some LatAm startups raising during the 2021 bubble.

❝

“In the U.S., you have liquidity, growth capital, and exit pathways. A high valuation makes sense. But here? You raise at $20M, and suddenly your next round looks mispriced.”

Andrés Londoño Botero

Still, YC helped them raise their seed round quickly, with many international investors (funds and angels) represented in their cap table.

Since then, they’ve brought on a local family office, which has helped balance the cap table and strengthen their presence in Colombia.

🌐 The Geography of Capital

“In New York, most funds are super U.S.-focused. Outside of Rappi or Nubank, they’re not familiar with the LatAm ecosystem.”

Andrés Londoño Botero

Instead, Andrés sees most U.S. LatAm-focused capital concentrated in places like Miami, Texas, and Silicon Valley, where there’s more regional familiarity and diaspora-led investing.

He’s currently raising a debt facility and talking to investors focused on emerging markets — including at least one group actively seeking deals in Colombia.

🇨🇴 Why Colombia?

Andrés is bullish on the Colombian tech ecosystem, even with the well-known constraints. Colombia ranks 38th globally and 2nd in South America in the StartupBlink Global Startup Ecosystem Index 2024.

“We’re seeing good momentum — fintech associations, groups like Invest in Bogotá, people pushing for better regulation.”

Andrés Londoño Botero

The Colombia Early-Stage 100 list, published by Ivan Montoya and NuMundo Ventures, is helping shine a light on emerging talent in the region, and includes Monet! Colombia Tech Week, which takes place in late August, is another boon for the ecosystem and its growth has cast a spotlight on all of the startup talent present there.

But the biggest challenge?

“There aren’t enough Series A and beyond funds In Latin America. If you get past seed, there are very few firms who can lead. Brazil is the exception, but Brazilians invest in Brazil.”

Andrés Londoño Botero

💡 IPOs and the Missing Middle

“In the U.S., you don’t need to IPO. You can just keep raising in the private markets. But in LatAm, there’s no private market liquidity.”

Andrés Londoño Botero

That’s a real problem.

Without secondary markets or consistent exits, it’s harder to prove that venture capital is an asset class that can return profits.

“We need more M&As, more IPOs. The whole flywheel is stuck.”

Andrés Londoño Botero

That’s why Monet is planning ahead.

They’re looking to grow via partnerships in Colombia, then expand into countries with similar regulatory frameworks for open banking and digital payments.

🚀 What’s Next for Monet

Monet is laser-focused on:

📊 Building robust analytics and credit models

🧱 Expanding infrastructure and direct bank integrations

💵 Securing debt capital to scale lending

🌎 Growing into other markets with regulatory compatibility

Andrés is excited but clear-eyed:

“We have to continue to capture our target market Colombia before we think about scaling. But the opportunity is huge — and we know the need is consistent in other countries in the region.”

Andrés Londoño Botero

🤝 Shoutouts: Zulu, Mural, and Pygma

We couldn’t end this episode without highlighting a few fellow builders who came up in our conversation:

🌐 Zulu – tackling cross-border transfers and FX for SMEs.

💸 Mural Pay – building crypto-enabled remittances with seamless UX.

Andrés believes cross-border infrastructure will be the next frontier — especially with companies like Revolut launching in Colombia, and regulation in Europe mandating real-time transaction settlement by 2026.

🌆 Pygma – Andrés is helping lead efforts to grow the Latino tech founder community in NYC, even as the city remains light on LatAm-focused VCs.

❝

“There’s a ton of interest in NYC, but still not many firms who understand LatAm. That’s why things like what Pygma is doing are important.”

Andrés Londoño Botero

📢 Listen to the full episode here.

Follow Andrés, because why wouldn’t you?

And check out Monet as they continue to expand access to credit in Latin America.

Thanks for reading!

Be sure to share La Frontera with your network if you enjoy our newsletters!