Alejandro Troll Bouroncle - GP, BVC

Podcast Notes, Episode 5 - LatAm VC Playbook: Investing Across Brazil, Colombia & Peru

La Frontera 🌵 Podcast, Episode 5 - LatAm VC Playbook: Investing Across Brazil, Colombia & Peru

Alejandro Troll Bouroncle

We met Alejandro Troll at a finca in Bogotá during Colombia Tech Week and were able to catch up with him again in Lima, Peru for happy hour Aperol Spritz’s this past December. What’s evident about Alejandro, besides his cool vibe and friendly persona, is his passion for his work. He is so involved in the local startup ecosystem that he himself helped cultivate in Lima, routinely connecting founders, investors, and educators through events and referrals. We’re excited to share his passion with you here, along with his unique insights!

It’s a fun episode; we encourage you to listen to the whole thing via these links! ⬇️

Episode 4 Summary

In this episode, we sit down with Alejandro, GP at BVC, to unpack the differences between venture ecosystems in Brazil, Colombia, and Peru—and why those nuances matter for startups and investors. We explore how BVC builds trusted deal flow in markets like Peru and Colombia, sources high-potential startups before they hit major accelerators, and works to educate Japanese LPs on the opportunity in LatAm. We also settle a critical debate: does Peru really have the best sushi in the world? 🍣

In Today's Newsletter

BVC: Investing Early-Stage Across ALL of Latin America

💰 Assets Under Management: $30M+ across two funds

📍 HQ: São Paulo, with local teams in Bogotá and Lima

🎯 Stage Focus: Pre-Seed and Seed

🌎 Geographic Focus: 50% Brazil, 50% Spanish-speaking LatAm (Colombia, Peru, Mexico, etc.)

📊 Check Size: $30K–$100K initial, with follow-on capacity

🏆 Exits: Multiple M&A exits from Brazilian portfolio, including Collact, bxblue, and Code Money

🚀 Notable Investments:

Linnda – E-commerce analytics platform for customer lifecycle and retention (Colombia)

The Hub – Same-day fulfillment and logistics using dark stores (Peru)

Cobre Fácil – Automated receivables and collections management for SMBs (Brazil)

Cubi Energia – Energy management and savings platform for businesses (Brazil)

Jobecam – Bias-reducing video hiring platform with anonymous candidate profiles (Brazil)

Treasy – Online financial planning and cost control platform (Brazil)

Sekure – Embedded insurance platform for insurers and brokers (Colombia)

Space Ag – Agtech platform for crop monitoring and farm data (Peru)

Lara – AI agent for human capital management and productivity (Argentina)

Alejandro and the BVC team are doing important work supporting overlooked founders and building local ecosystems from the ground up.

“We drive regional development by supporting innovation with impact.”

BVC invests in early-stage startups building in emerging markets, with a strong focus on B2B models, capital efficiency, and local market traction. What sets them apart is their hands-on support, deep knowledge of nascent ecosystems like Peru and Colombia, and their unique bridge between Latin America and Japanese investors🌎.

From Corporate to VC: Alejandro’s Jump into Venture

Alejandro’s route into VC was a bit unplanned. Originally from Peru, he was leading digital transformation at Telefónica across Latin America and living in São Paulo. That’s where he started working with startups through their CVC arm 🚀.

Later, he reconnected with his MBA classmate Mitsuru—now co-founder of BVC—and the two teamed up to expand VC access beyond Brazil. “Brazil was heating up around 2014–2015,” Alejandro said, “but Colombia and Peru were still in early innings. We wanted to help shape those ecosystems.”

Brazil vs. Colombia/Peru: Two Very Different Playing Fields

Brazil’s ecosystem is years ahead of Spanish speaking LatAm. Alejandro broke it down:

Brazil has a well-developed capital market, layered with everything from large private equity and secondary funds to active family offices and individual angel investors. “Family offices in Brazil have been investing in tech for a while,” Alejandro shared. “They’re more comfortable with risk. They’ve seen IPOs, M&As, and unicorns happen.” That comfort with liquidity cycles means investors are more likely to recycle capital—and stay in the game during downturns. 💸

More exits, more unicorns 🦄, more IPOs mean more investor education and appetite. Latin America is home to 45 unicorn companies as of 2024, and Brazil accounts for half of them. Employees of unicorns become second-time founders (the “mafia effect”), angel investors, or even fund managers themselves.

Brazil’s government, despite its bureaucracy, has been relatively progressive in setting up frameworks that support sectors like fintech and open banking. For example, the Central Bank of Brazil launched PIX, an instant payments system in 2020 that’s now used by over 140 million people 🔥.

Contrast that with Peru, where regulation is still slow-moving and lacking when it comes to enabling financial innovation or digital infrastructure.

Finally, Brazil’s sheer scale matters. With over 215 million people and a large middle class, a startup can become a billion-dollar company without ever leaving the country.

“In Colombia or Peru, you need to expand. In Brazil, you can build big just by staying local,” Alejandro explained.

Why BVC Expanded to Spanish-Speaking LatAm

Brazil still makes up about 50% of BVC’s focus—it’s the more liquid, agile market. But Colombia and Peru? That’s where BVC has been able to make a big impact.

“Better terms, less competition, and we can be a more relevant player,” Alejandro told us. “There are 50+ VC firms in Brazil. In Peru, maybe 4. In Colombia, just a handful.”

Alejandro Troll Bouroncle

At the same time, Colombia is moving fast thanks to ecosystems spun out of unicorns like Rappi, Habi, and Mercado Libre—the so-called “mafias” that create second-gen founders 💼➡️💡.

Sourcing Startups & Building Local Networks from Scratch 🧭🤝

When Alejandro moved back to Lima in 2019 to expand BVC’s presence beyond Brazil, he wasn’t parachuting into a ready-made ecosystem—he was building from zero.

“I had a strong VC network in São Paulo, but in Peru? Nothing,” he admitted. “It was truly starting from scratch.”

So how did BVC plant roots in new and underdeveloped markets like Peru and Colombia?

🏛️ Tapping into Peru’s University Innovation System

One unexpected advantage? Peru mandates every university to run an innovation initiative—whether that’s an entrepreneurship course, an incubator, or even a fully-fledged accelerator.

“This became a key entry point,” Alejandro explained. “I reached out to my alma mater and said, ‘I’m back in Lima, and I want to connect with early-stage entrepreneurs.’” From there, the doors opened.

These university programs gave BVC early visibility into new founders—and a chance to mentor and guide them before they even launched their first products 🚀.

🌐 Local Accelerators, Friends, and Founder Referrals

Alejandro also leaned on a close friend from business school who was building a startup in Lima. That friend became a connector—introducing him to local accelerators, government innovation hubs, and fellow founders.

But over time, the most valuable sourcing channel turned out to be BVC’s own founders.

“Our best deals often come from portfolio founders,” Alejandro told us. “Once you’ve backed someone, and they trust you, they’ll refer other serious founders your way. That network becomes exponential.”

📣 Building Awareness Through Events & Educational Programs

In newer ecosystems like Lima or Bogotá, where VC isn’t as deeply embedded as in Mexico or Brazil, visibility is everything.

To stand out, BVC launched:

Webinars and workshops on fundraising best practices 💡

Open calls for startups, signaling accessibility 🎯

Partnerships with incubators and public innovation agencies, like Telefónica’s Wayra and state-backed programs like Innovate Perú 🇵🇪

BVC also runs a unique internal program—not quite an accelerator, but a fundraising-readiness program focused on helping early founders improve their pitch, sharpen their metrics, and understand what VCs actually look for in diligence.

For the select startups that stand out, BVC writes an initial $30K check—then monitors progress for potential follow-on investments of $100K or more 📊.

🎯 The Challenge of Catching Startups Early Enough

In many LatAm markets, once a startup gets into a top-tier accelerator like 500 Global, Rockstart, or Platanus, their valuation jumps—and early-stage investors like BVC are priced out.

That’s why the timing of discovery matters as much as the quality of the startup itself.

“It’s all about timing,” Alejandro said. “You want to meet great founders before they hit the big accelerators—because after that, valuations can triple.”

To widen that window, BVC is actively forming alliances with accelerators—looking for ways to co-invest or stagger checks, rather than compete.

🧠 Building Trust with Founders

In less developed VC markets, founders are often skeptical of investors—especially if they’ve had bad experiences with “tourist capital” during the 2021 boom.

So Alejandro emphasized that sourcing isn’t just about outreach. It’s about trust.

“We meet with founders multiple times. We give feedback even if we don’t invest. And we always respond on LinkedIn—even if it’s a ‘no,’ we explain why.”

Alejandro Troll Bouroncle

This reputation has become one of BVC’s key sourcing advantages: being early, being helpful, and being real.

Fintech, AI, and the Sectors to Watch

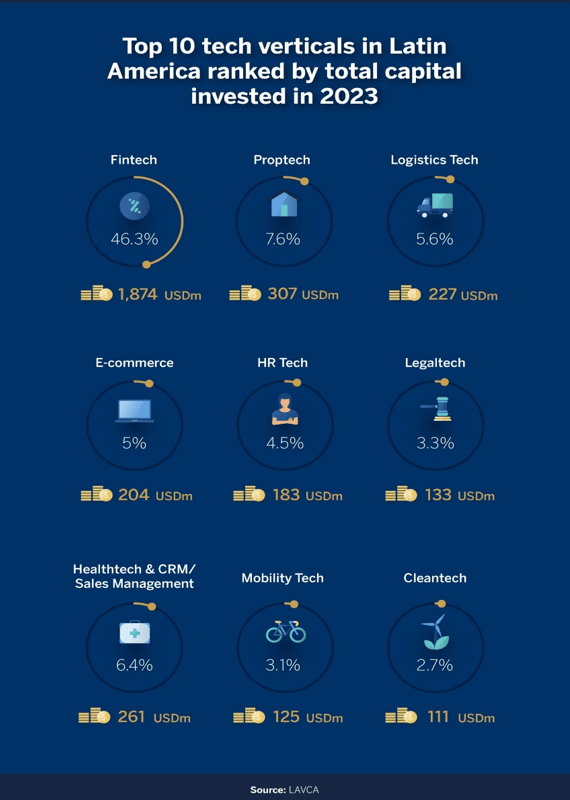

Fintech still dominates LatAm VC—accounting for 40–50% of deals. But Alejandro’s seeing some exciting shifts 🌎.

“What’s hot right now is B2B startups using AI to help companies get more efficient,” he shared. “HR, operations, retail—these founders are using existing AI tools to move faster and cheaper.”

Other emerging verticals? Biotech, cleantech, and foodtech 🌱🧬🍤—especially in Chile and Argentina. They’re still niche, but growing fast. “Personally, I’d love for us to dive deeper into those sectors,” Alejandro said.

Valuations, Exits & Fund Strategy

At BVC, the sweet spot for investing is $1M–$5M valuations at the pre-seed and seed stages 💵.

And exits? “We’re not chasing unicorns,” Alejandro said. “We’re seeing most exits in LatAm come in under $40–50M.” Even in Brazil.

That’s why their strategy is to exit around Series B, often through secondaries or M&A 🤝. “We don’t want to drag out our funds. Liquidity matters. DPI matters.”

Educating International LPs—Especially from Japan

Most of BVC’s LPs are from Japan. Some are former Bain colleagues, others are founders who’ve IPO’d, and some are involved through JICA (Japan’s international development agency).

Why Japan? Two big reasons:

Japan’s economy is stable, but slow. Latin America offers higher-growth opportunities 🌱

They see parallels between Latin America and Southeast Asia—fragmented, emerging markets where digital infrastructure is still being built

“We host investor missions every year—bringing our LPs to Lima, letting them meet startups, and yeah… we take them to Central,” Alejandro said with a grin 🍣.

And who has the best sushi? “Peru,” he said confidently. “It’s not traditional sushi—it’s sushi mixed with Peruvian flavors. Think ceviche meets nigiri. Way more flavor.”

Alejandro Troll Bouroncle

…Definitely no Peruvian bias,👆️ there!😉

Bridging Ecosystems: From Lima to Tokyo

Alejandro also told us about BILA, a joint program with JICA to connect Latin American startups with Japanese government-backed support 🤝.

It turns out Japan faces its own tech challenges—like still digitizing ID systems or addressing aging populations. Latin American startups that have solved these issues at home can offer ready-made solutions abroad 📈.

“There’s real synergy here,” Alejandro explained. “And it’s mutual—we’re learning a lot from Japan’s discipline and long-term thinking.”

Follow Alejandro for more insights

If you’re an early-stage founder in LatAm—especially in Colombia or Peru—Alejandro wants to hear from you. Drop him a note on LinkedIn 📬. BVC is active, supportive, and looking to back the next big thing. Check out their events calendar here!

Thanks for reading!

Be sure to share La Frontera with your network if you enjoy our newsletters!